Crypto's biggest criminal could spend 110 years behind bars

Sam Bankman-Fried used to be the hero of cryptocurrency. He built a multi-billion dollar empire long before he turned 30 but when it all came crashing down this former icon of digital money became the crypto world's biggest villain. This is how it all happened and how much jail time he's facing.

Bankman-Fried was arrested in the Bahamas at his luxury apartment in December 2022 just one month after his cryptocurrency exchange FTX collapsed in spectacular fashion, and he was later extradited to the United States to face a series of worrying charges.

The New York Times was one of the first media outlets to report on the one-time crypto mogul’s arrest and revealed that Bankman-Fried was facing charges that included wire fraud, securities fraud, and money laundering for his role in the collapse of his company.

Bankman-Fried’s FTX Crypto Exchange was once the envy of the digital currency world and became the largest exchange of its kind. However, it all fell apart fairly quickly after it was revealed that the company wasn’t quite what it seemed

The cryptocurrency news website CoinDesk reported on November 2, 2022, that it had obtained leaked documents from Alameda Research, a trading firm connected to FTX, showing that the company’s reserve funds were made of its cryptocurrency called FTT.

The leaked documents also indicated that Alameda Research had been using the funds of FTX as collateral against its loans and the whole scheme quickly began to unravel as the world came to learn about the true nature of Bankman-Fried’s rather phony success.

Crypto researcher Dirty Bubble Media wrote at the time that it was almost as if Bankman-Fried had “found a way to hack the financial system, printing billions of dollars out of thin air against which he was able to borrow massive sums from unknown counterparties.”

This news shocked the cryptocurrency community; however, longtime rival and Binance CEO Changpeng Zhao took the opportunity to take a shot at FTX and tweeted his company planned to fully liquidate its $580 million position in FTT according to Forbes.

Zhao’s move had wide-ranging consequences for the crypto market and FTX, prompting traders of all sizes to begin pulling their investments off of FTX and selling as much FTT as possible. This ended up tanking the value of FTT and the crypto market as a whole.

Bankman-Fried took to Twitter one day after Zhao’s message and said, “a competitor is trying to go after us with false rumors.” Bankman-Fried continued, adding “FTX is fine. Assets are fine,” according to Business Insider. But FTX wasn’t fine.

Zhao announced on November 8th that Binance was looking to help FTX but quickly pulled out of the deal according to CoinDesk because FTX’s liquidity problems were beyond Binance’s “control or our ability to help.” What happened next was a disaster.

FTX’s leadership began a desperate search for help and Market Watch reported Bankman-Fried tweeted that he had “F'd up, and should have done better.” FTX lost $32 billion dollars overnight according to The Motley Fool and the company filed for bankruptcy on November 11th, 2022.

In the days and weeks that followed the collapse of FTX, rumors about improprieties at the company while big investors, institutions, retail traders, and crypto depositors were left with hundreds of tens of billions in losses.

However, there was one question on everyone’s mind who had a stake in the collapse of FTX: What would happen to Bankman-Fried for his role in the FTS mess? This would be answered in the courtroom when the former crypto mogul was found guilty by a jury.

BBC News reported that Bankman-Fried was found guilty of lying to investors as well as lenders, and for stealing billions of dollars from his company—$8 billion was found to be missing in November 2022—which led to FTX’s collapse.

"Sam Bankman-Fried perpetrated one of the biggest financial frauds in American history — a multibillion-dollar scheme designed to make him the king of crypto," explained the U.S. Attorney Damian Williams in a statement after Bankman-Fried’s verdict was read.

Williams added: "This case has always been about lying, cheating, and stealing and we have no patience for it.” Bankman-Fried had pleaded not guilty but the evidence against him showed that he did not safeguard the funds of his clients as he promised to do.

Bankman-Fried was found guilty on five charges that carried a maximum life sentence of 20 years each according to BBC News, while the other two charges that he was found guilty of carried a penalty of up to five years in prison.

"He took the money. He knew it was wrong. He did it anyway, because he thought he was smarter and better and that he could figure his way out of it," explained Assistant U.S. Attorney Nicolas Roos in his closing arguments of the case.

Bankman-Fried is set to discover his eventual fate on March 24th, 2024, when he's sentenced. He faces a maximum of 110 years in prison if Judge Lewis Kaplan gives the former crypto hero the maximum sentence with consecutive terms according to NBC News.

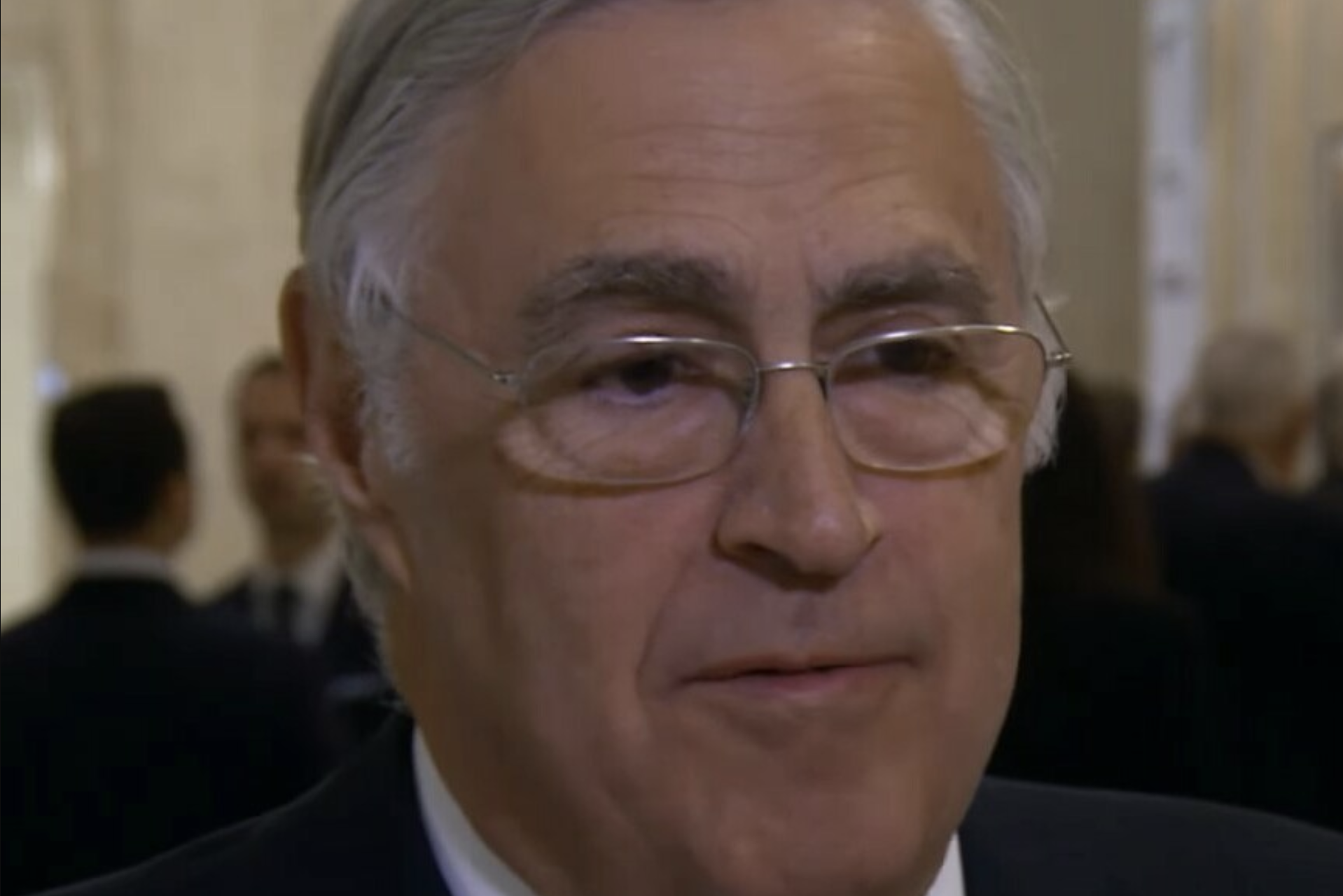

Photo Credit: Wiki Commons By Administrative Office of the United States Courts

Bankman-Fried still faces another trial in March according to the American media outlet, which noted that it may be even more serious for him since the Department of Justice alleges that he bribed Chinese officials. It is certainly an interesting end for crypto’s greatest criminal.

More for you

Top Stories