Stock markets around the globe are going up thanks to this one tech company

Financial markets from New York to Hong Kong can only talk about one thing. The big technology companies have captured the attention of investors, but one company stands high above the rest: Nvidia.

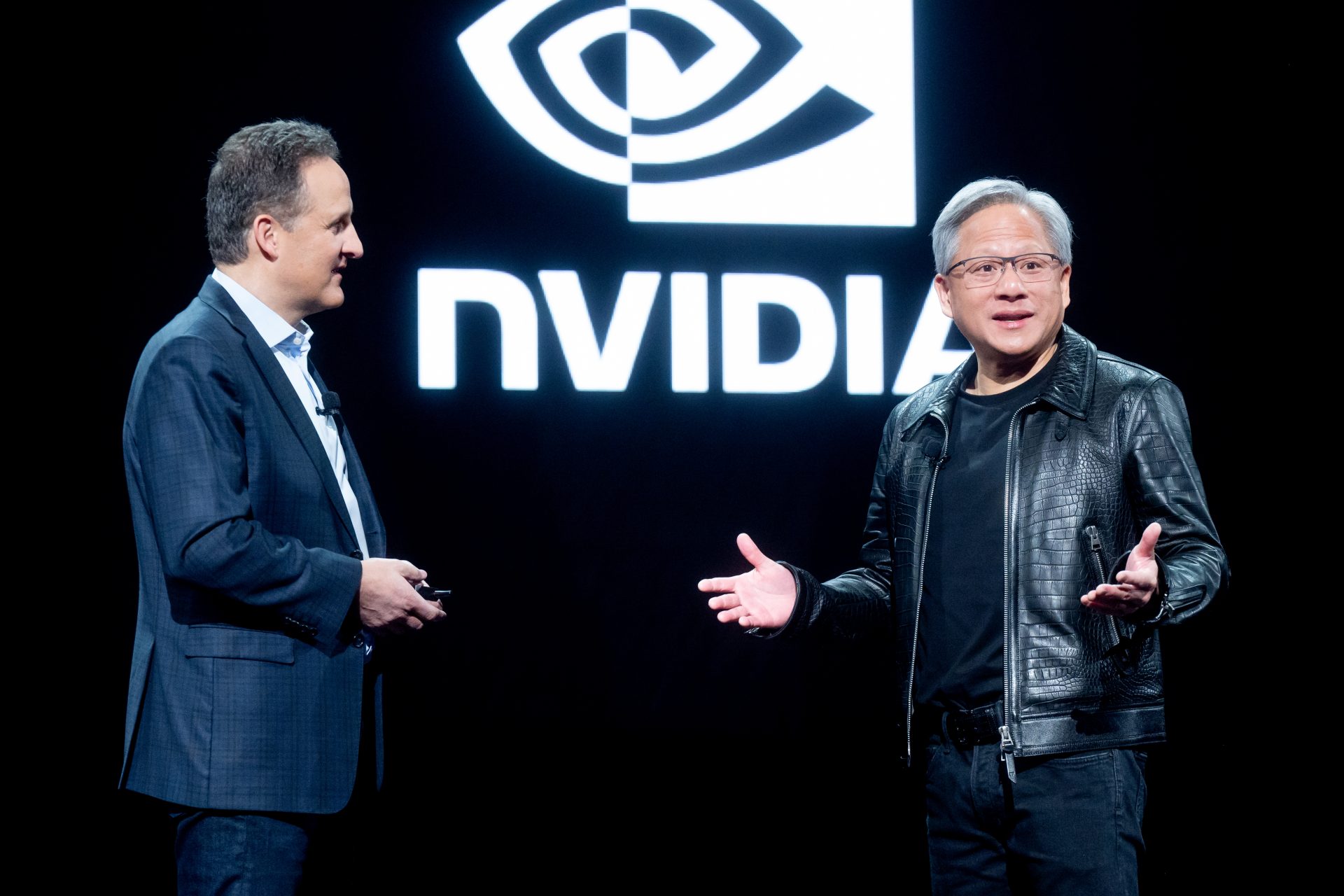

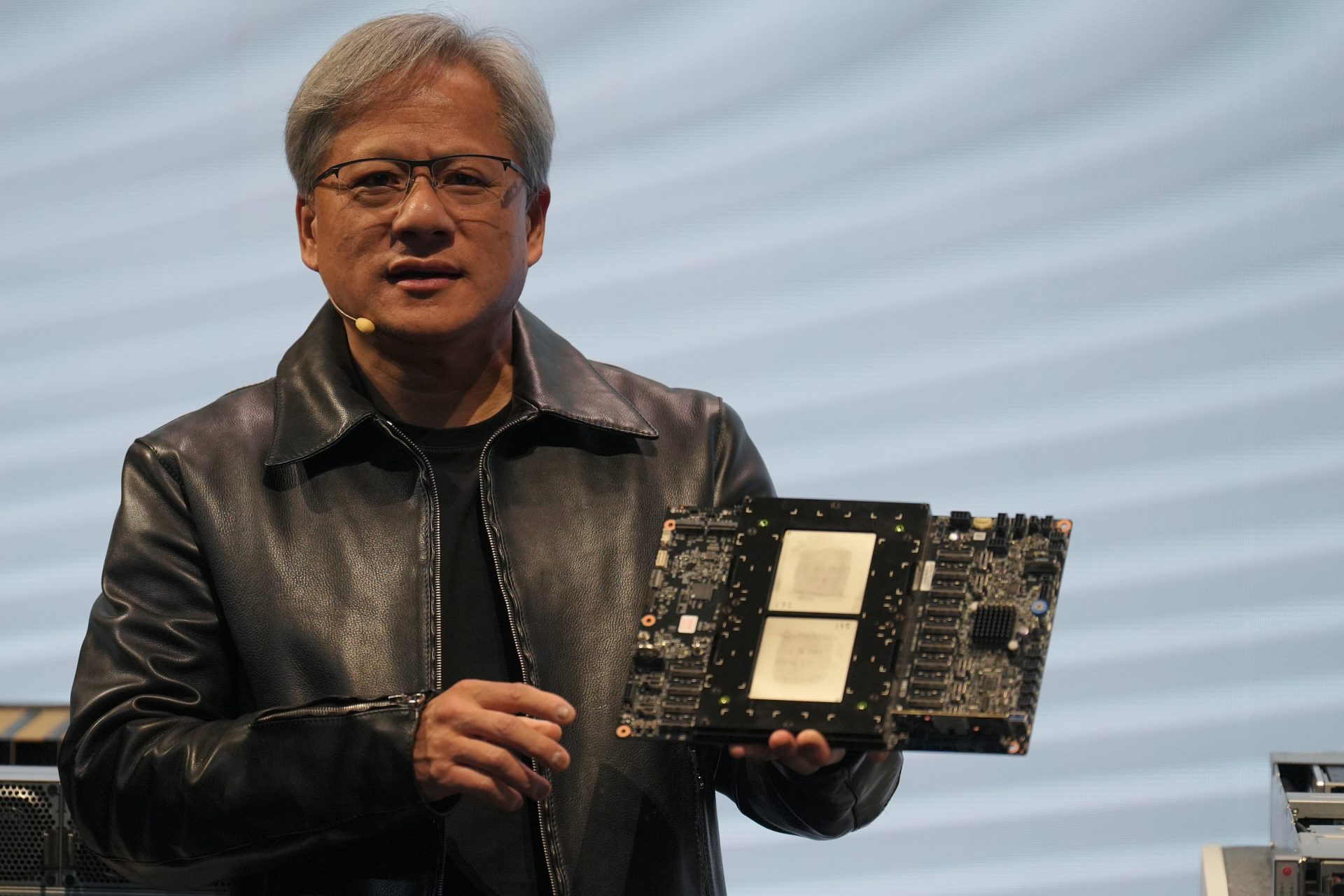

Jensen Huang, founder and CEO of Nvidia, created the company in 1993 with Chris Malachowsky and Curtis Priem. At that time, they hesitated about what to name it. At first, they called it NV, for “Next Version”. Then they looked for a name that started with these same letters and chose “invidia”, a Latin word that means envy.

The Santa Clara, California-based company manufactures Graphics Processing Units (GPUs) and controls approximately 80% of the market.

When it started in 1993, the company manufactured chips for developing video games. As the BBC explains, large companies noticed their products early on. Among them, Google, Microsoft, and Amazon stand out, which saw Nvidia processors as a useful tool to boost their data centers.

The company soon realized that the processors could also be used to train artificial intelligence. With the launch of ChatGPT, an artificial intelligence chatbot application developed by OpenAI with Nvidia processors, the firm became one of the big names in the industry.

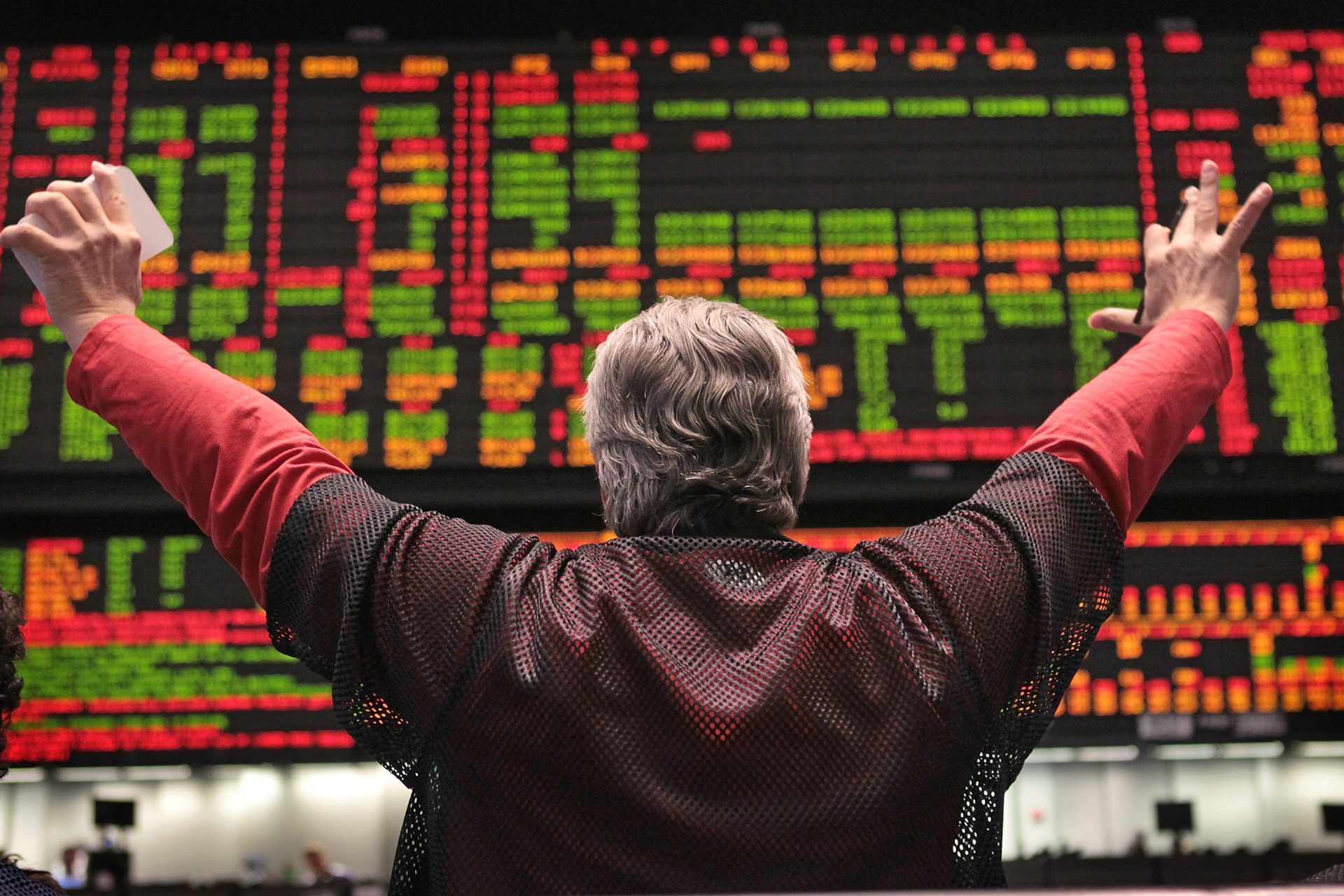

Nvidia recently presented results that unleashed euphoria in the markets. The company obtained a profit of $29.76 billion in 2023, 581% more than the previous year. Revenue increased 126%, to exceed $60.9 billion.

After the announcement, investors rushed to buy shares from the company, which rose to 16.4% in a single day, to $785.38. With this increase, the company increased its valuation by 273.1 billion dollars in one session, reaching almost 2 billion.

Nvidia's good results spread to big names in tech such as Meta, Amazon, Microsoft, and Netflix, whose stock also went up. Overall, The Nasdaq rose 3% in a single day.

In the United States, Nvidia also pushed the S&P 500, Wall Street's benchmark index, to break new all-time highs and record its best day since January 2023, according to the Financial Times.

Investor optimism knows no borders and has reached Europe. The Stoxx Europe 600 index, which includes the 600 largest companies in the old world, reached its highest markup in history.

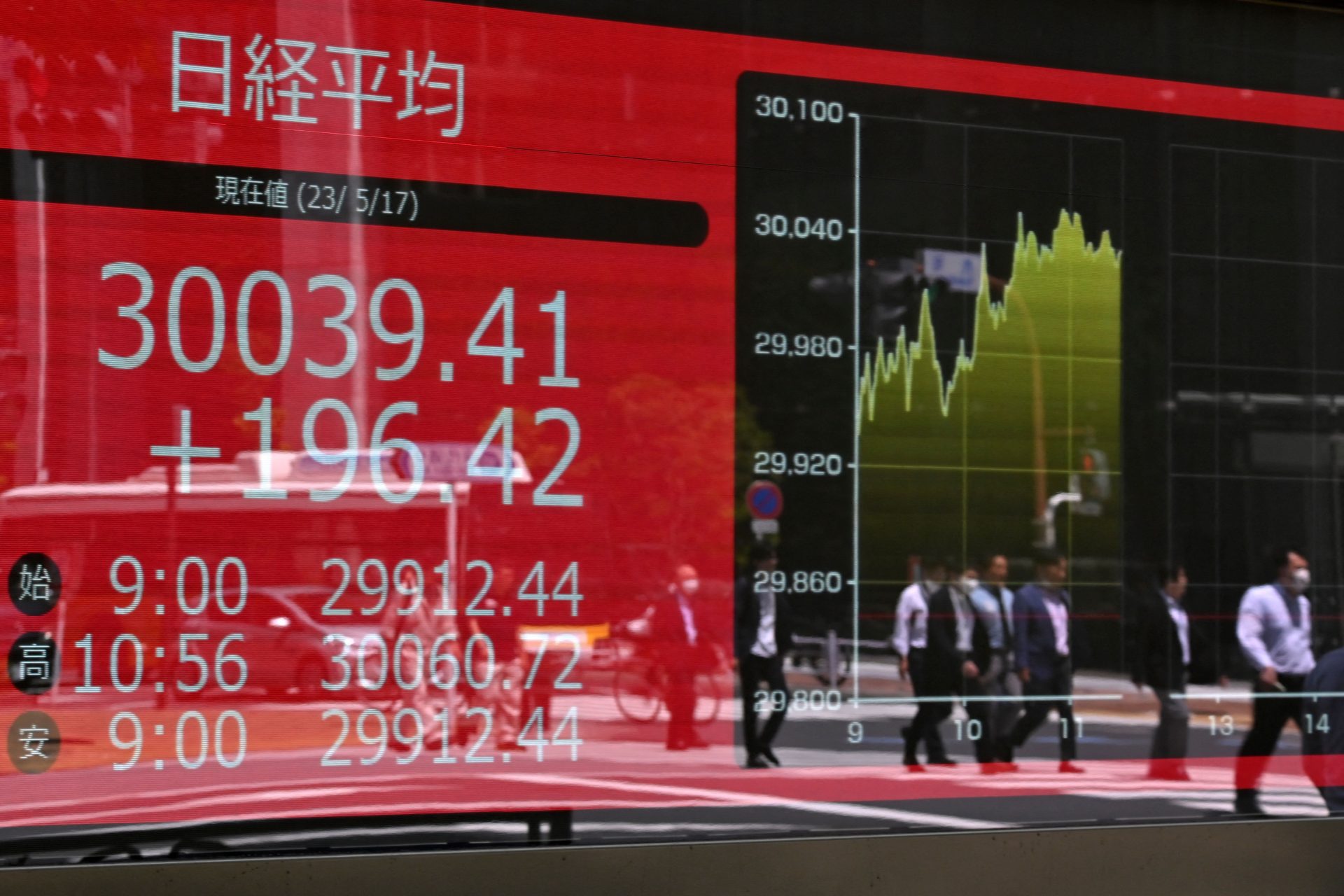

The Nikkei, Japan's top stock market, returned to levels unseen in decades after Nvidia's results, thanks to the optimism brought by the microchip manufacturers listed on the index.

Nvidia's success has been stellar in recent years, and this can be seen in its stock market performance. It has gone up more than 63% since January and, in one year, it has risen over 230%.

Expectations over AI have led Nvidia to become the third most valuable publicly-listed corporation in the United States, leaving behind Amazon and Alphabet.

In presenting the company's results, Jensen Huang, founder and CEO of Nvidia, stated that accelerating computing and generative artificial intelligence have reached “an inflection point,” with increasing demand in companies, industries, and governments.

Faced with optimistic predictions, the company continues to grow heading towards the next challenge: reaching the same level of other technological behemoths, such as Apple and Microsoft.

However, experts fear a new bubble in the tech sector is in the making, similar to what happened in the early 2000s. Back then, global stock markets soared thanks to dotcom companies linked to the internet but collapsed a few years after.

More for you

Top Stories