Americans in poverty are kept poor thanks to a phenomenon known as the Ghetto Tax

The United States is a nation of those who have wealth and those who don't, and if you are one of the millions of individuals living in poverty, the Ghetto Tax works to prevent you from reaching the upper rungs of society. But what is the Ghetto Tax?

The Ghetto Tax isn’t really tax, but rather the extra costs incurred for the everyday goods and necessities needed by those living in poverty, and it can have a seriously negative effect on the poorest people in the United States

Photo by Joel Muniz on Unsplash

Everything from groceries to government services can cost a lot more money when you’re poor in America, and science has proven it. Researchers have been looking at the phenomenon for well over a decade.

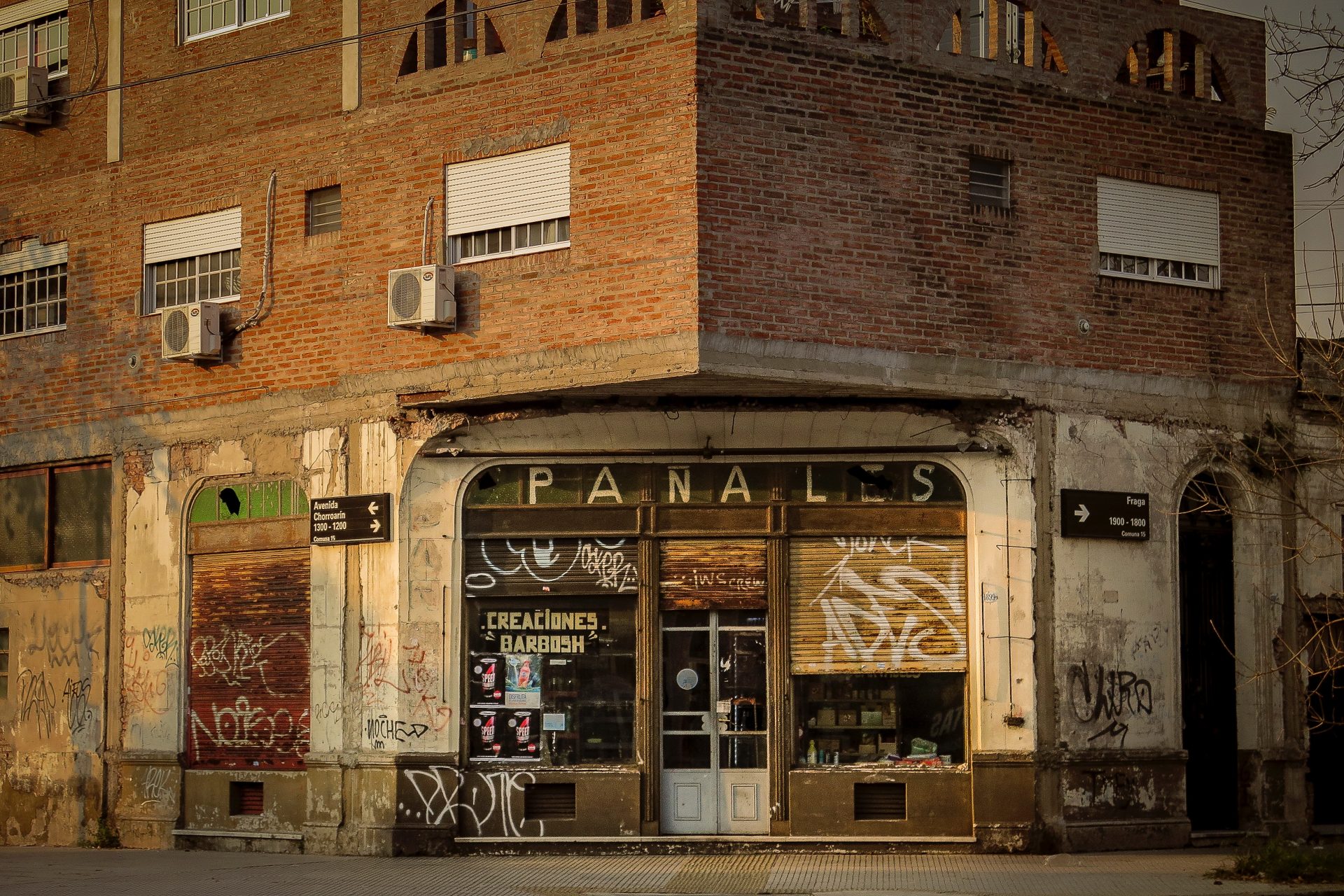

Photo by Barthelemy de Mazenod on Unsplash

Take for example a 2018 study from the Public Policy Institute of California that revealed the average poor family living in a low-income area was spending a lot more on its fresh produce just because of where they were shopping.

Photo by Joshua Rawson-Harris on Unsplash

Produce prices across three store types in the low-income areas studied cost those who shopped there more on average than the reference prices of matched supermarket chains. So how bad were the markups on produce?

Photo by Alexandr Podvalny on Unsplash

Large grocery stores had prices that were 27% higher, smaller markets had prices that were 37% higher, and convenience stores had a whopping 102% higher markup on the produce that they had available for sale on average.

Photo by Marcela Rogante on Unsplash

What was interesting about the study was that its researchers looked at 225 low-income neighborhoods with 622 convenience stores, 621 small markets, and 231 large grocery stores—and showed that high-cost options were more available.

Photo by Tim Mossholder on Unsplash

Access to large grocery stores and supermarkets is limited for some low-income areas around the country according to the U.S. Department of Agriculture (USDA), which has led to the use of the term “food deserts” for those areas.

Photo by Mick Haupt on Unsplash

Research from the USDA published in 2017 found that as many as 39.2 million people in the U.S. were living in low-income and low-access areas. That was a stunning 12.8% of the American population that faced a food issue.

Other research has found that the poor have to cough up more for every type of product or foodstuffs. for example, 2015 data reviewed by the Washington Post found the poor end up paying more for some products but the real problem was a lack of competition to develop products for a poorer market.

Photo by Charles Deluvio on Unsplash

However, it isn’t just food and retail doods that cost the country’s poor more than wealthier Americans. Insurance premiums also cost low-income individuals more on average according to a 2017 study from ProPublica and Consumer Reports.

Photo by bruce mars on Unsplash

Analysis of premiums and payouts in California, Illinois, Texas, and Missouri revealed that insurers charged minority neighborhoods upwards of 30% more for auto insurance than someone driving in a wealthier area.

Photo by Johannes Krupinski on Unsplash

Poorer Americans also end up paying more for basic utilities like water and electricity according to a report from the Urban Institute, which noted that utility costs end up taking up a larger portion of a lower-income household's money.

Photo by Jason Richard on Unsplash

In 2006, the Brookings Institute found that 4.2 million lower-income households had paid more for their mortgages than richer individuals, 4.5 million low-income households paid higher prices for auto loans, and 1.6 million poorer adults paid excessive fees for furniture, appliances, and electronics.

“Countless more pay high prices for other necessities, such as basic financial services, groceries, and insurance,” the Brookings Institute explained on its website about the findings of its report on the cost of poverty in the U.S.

Photo by Alistair MacRobert on Unsplash

“Together, these extra costs add up to hundreds, sometimes thousands, of dollars unnecessarily spent by lower-income families every year,” the institute continued. But can this be overcome are America’s poor doomed to pay the Ghetto Tax?

Photo by Alexander Grey on Unsplash

The Brookings Institute suggested that the issues facing America’s poorest could be overcome with intervention from the government, nonprofits, and business leaders to change regulatory incentives and reduce the cost of living of the country’s poor.

Photo by Austin Distel on Unsplash

“Reducing the costs of living for lower-income families by just one percent would add up to over $6.5 billion in new spending power for these families,” the institute wrote. Unfortunately, little seems to have changed since the report was published.

More for you

Top Stories