Can the U.S. handle an oil crisis with its low strategic reserves?

Another major national crisis could soon hit the United States but it isn’t the problem you're thinking about. America’s Strategic Petroleum Reserve is down to around 60% of its stockpile and this could have grave consequences.

How and why the Strategic Petroleum Reserve is running lower than normal isn’t difficult to answer. Joe Biden sold off about 40% of the stockpile over the last year in order to deal with the issues caused by Russia’s invasion of Ukraine.

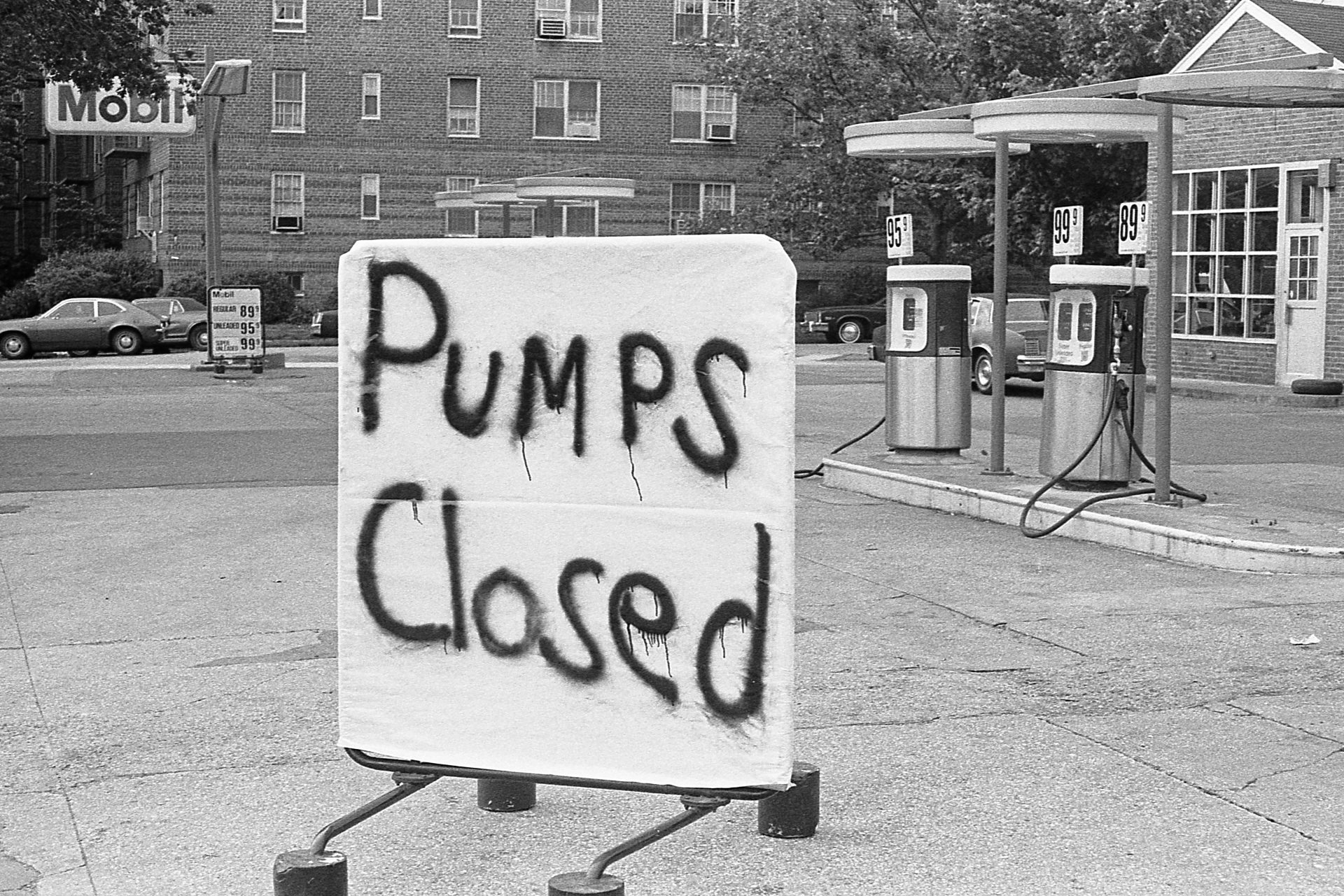

Politico reported that the oil sell-off helped the United States limit rising fuel prices in the wake of Russia’s invasion but added that it also left American oil reserves at their lowest levels since the early 1980s, which is a big problem.

Republicans have been using the issue as a political hammer to berate the president and his administration for allegedly making the country more vulnerable to a disruption of global oil supplies at a time when more war looms large.

The recent terrorist attacks in Israel have increased fears that a wider regional conflict in the Middle East could be developing and such a situation would undoubtedly impact the global oil trade in a variety of very painful ways.

“Any Middle East conflict sends tremors throughout the world economy,” Director of the Middle East & Africa Region at the Economist Intelligence Unit Pat Thaker told CNBC, adding the area was crucial for energy and trade.

Thaker explained that the Middle East was home to many of the world’s most important trade passageways in addition to being “a very crucial supplier of energy. The knock-on effects of a war could send oil prices skyrocketing.

Oil prices initially jumped after Hamas launched its attack on Israel in early October according to CNBC. But prices eventually stabilized, though that may not last if a wider regional war breaks out and affects the region's oil producers.

For example, even a modest escalation could result in sanctions tightening against Iran, the eighth-largest oil producer in the world, and could remove as many as 1 million barrels a day from global circulation. But things could get worse.

“Any expansion of the war into the Sinai Peninsula and Suez region increases the risks of an attack on energy and non-energy trade flowing through the Suez Canal,” Thaker explained, and that would be very bad for oil prices.

The Suez Canal accounts for nearly 15% of global trade according to Thaker, which includes 45% of the world’s crude oil as well as 9% of its refined oil. 8% of the world’s Liquid Natural Gas tankers transit the route, too.

“You choke off those points and you create major disruption not just to oil prices, but the whole supply chain of the world for energy and other goods as well,” Thaker added. But what would this mean for oil in the United States?

At present, the American Strategic Oil Reserve still has 351 million barrels of oil which is equal to 56 days of total imports from last year in the U.S. according to Politico, which is down from the 727 million barrel peak the country had under Barack Obama.

Private companies currently hold an additional 424 million barrels of oil and U.S. Energy Secretary Jennifer Granholm explained in a September House committee that she was not worried about the country’s reserve levels at that time.

“It is the largest strategic reserve in the world,” Granholm explained. But there is still a danger that the United States could be cut off from purchasing petroleum by some oil-producing states in the Middle East if war breaks out.

BCA Research analyst Bob Ryan told Politico that a fully stocked oil reserve wouldn’t have necessarily protected the United States against price shocks if war in the Middle East broke out, but it could have helped.

The current low level of oil in America’s strategic reserve “leaves the U.S. in a position of relying on Saudi Arabia and others with spare capacity to ramp supply in the event of a cutoff” of Iran’s oil Ryan explained in an email to the news organization.

“This is the third wake up call in four years that maybe it’s not a good idea to mindlessly sell off our strategic reserve,” said Bob McNally, an energy expert who served as Senior Director for International Energy on the National Economic Council under George W. Bush.

The New York Times reported on October 25th that Biden administration officials were already working on plans to keep American gasoline prices low if global oil prices rose, which could include a new round of release from the country’s strategic reserve.

The Biden administration is also having discussions with large oil-producing nations like Saudi Arabia who are currently holding back their supply in an attempt to get them to pump more oil based on comments from one unnamed administration official.

What will happen next is not yet known but it’s unlikely that the world will see a stable oil price in the global market for the foreseeable future. With war looming and the American strategic reserve running low, things could get bad quickly.

More for you

Top Stories