Europe prepares for a hostile America

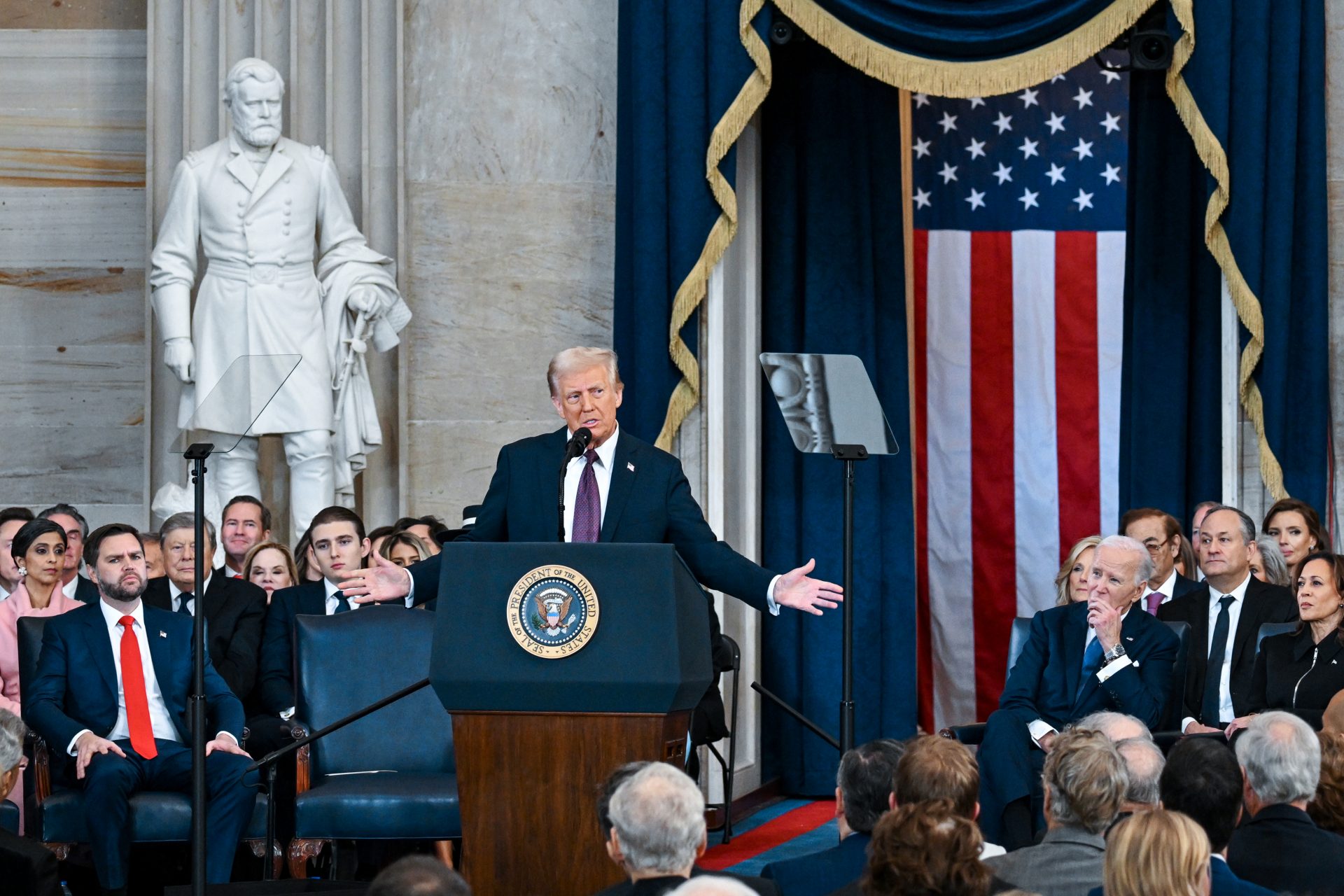

After decades of progress in social protection, European welfare states are facing a critical situation due to growing economic and demographic pressures, exacerbated by the re-election of Donald Trump.

Europe is anticipating an impact on key sectors such as the automotive industry, energy and its currency, as well as a potential inflation comeback.

Trump's campaign promises, covering issues such as immigration, tariffs, Ukraine, cryptocurrencies and energy, are all being addressed at breakneck speed. If fulfilled, these policies could profoundly alter the eurozone's economic and political landscape, according to Euronews.

Top world leaders are bracing themselves for Trump's next moves. Generating the most concern are tariffs and the US position on the conflict in Ukraine, key aspects for the global economy and politics, according to CNN.

Tariffs, described by Trump as "the most beautiful word in the dictionary", pose a critical challenge for Europe. With tariffs of 25% on its US exports, Europe's key sectors could be weakened and its economic engine put at risk, according to Euronews.

The German car industry in particular will be hurt by Trump's tariffs, forcing European manufacturers to move their production to the US, which in turn will lead to job losses in Europe, according to Euronews.

The growing pressure to increase NATO military spending could divert crucial funds from social programs, limiting European countries' ability to fund government services such as health, education and welfare. This redistribution of resources compromises the sustainability of social welfare systems and potentially triggers social tensions.

Since the end of the Cold War in 1991, Europe has saved $1.9 trillion through reduced defense spending, known as the “peace dividend,” according to CNN. This has allowed for a significant expansion of welfare states, although, according to researchers at the Ifo Institute in Germany, this expansion is not matched by the continent’s overall economic development.

Even a modest increase in defence spending would put pressure on already strained government finances. European governments meanwhile need to invest in the energy transition to address climate change, posing complex strategic choices, according to the Ifo Institute.

Europe is also facing a critical demographic challenge due to its ageing population. Peter Taylor-Gooby of the University of Kent points out that the elderly already represent the biggest financial burden on the European welfare state.

In Germany, the continent's largest economy, a minimum of 2% annual growth is required to maintain the pension system, but the economy has contracted in recent years, aggravating the pressure on public finances, according to CNN.

Low birth rates and an ageing population in Europe are shrinking the workforce and hampering investment in education and technology, which are essential for improving productivity. McKinsey warns that this trend could slow GDP growth per capita in Western Europe by as much as $10,000 per person per year in the coming decades. To counter this, major economies currently experiencing a slowdown would need to accelerate their productivity gains.

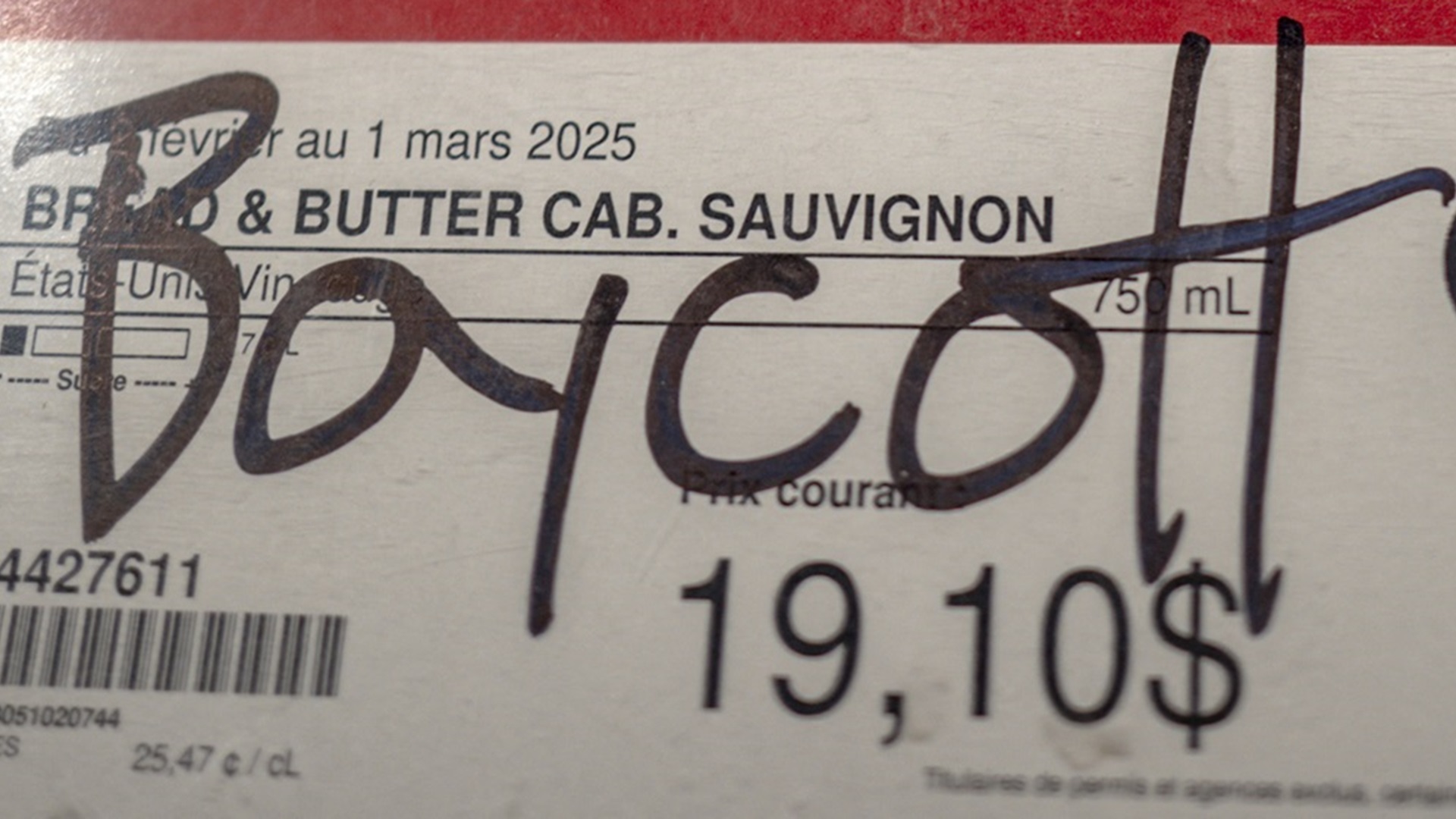

However, unlike in 2016, when Trump first took office, the EU now knows what's it's dealing with and is better prepared. The European Commission has identified US products that could be subject to retaliatory tariffs if – or rather when – Trump's threats are carried out. However, asset manager Edmond de Rothschild warns that despite this, trade tensions with the US will continue to affect confidence and growth in Europe.

To avoid Trump's tariffs, the EU could increase its energy imports from the US, a proposal backed by European Commission President Ursula von der Leyen after the Russian gas tap was turned off.

This would give the US a key position in pricing and increase its influence in global crude markets, leaving Europe with limited options and greater dependence on American supplies.

Trump’s policies could strengthen the dollar, weighing on the euro and pushing the EUR/USD exchange rate below parity, according to Goldman Sachs analyst Kamakshya Trivedi. This scenario would be driven by new tariffs and strong US economic performance, increasing pressure on the eurozone.

The Bruegel think tank says tariffs would be a "negative supply shock" to the EU economy. However, the US fiscal stimulus, together with a stronger dollar, could boost demand for European exports, partially mitigating the damage. The final impact will depend on the response of the European Central Bank, which will play a crucial role in macroeconomic balance.

Rising geopolitical tensions reinforce the need for Europe to seek greater strategic autonomy to protect its interests in an uncertain global environment.

According to Christine Lagarde, President of the European Central Bank, the continent must adapt to a changing geopolitical and economic environment, regaining competitiveness and innovation to ensure its ability to sustain the welfare state. If it fails to do so, Europe risks losing the resources needed to maintain the standards of living and social stability that have characterised its economic model.

Never miss a story! Click here to follow The Daily Digest.

More for you

Top Stories