The great wealth transfer: how rich boomers are passing down trillions to their kids

Calling it the greatest wealth transfer in the history of humanity, $84 trillion in assets is set to be transferred in the next 20 years, according to the report U.S. High-Net-Worth and Ultra-High-Net-Worth Markets by consulting firm Cerulli Associates.

$84 trillion is such a large number it is hard to fathom. But let’s try. USA Today puts it like this: “Go back a billion seconds and you'd be in 1995. Go back a trillion seconds and you'd be around 30000 B.C.” In 2023, the US government spent $6.13 trillion — so that wealth transfer would fuel 13.7 years of spending like that.

Ok, boomer! Yes, it is the generation largely mocked by their younger counterparts who have the bulk of the cash. They are expected to give away $53 trillion in the US. The Silent Generation, born between 1928 and 1945, is estimated to leave behind $15.8 trillion.

According to the New York Times, there are two main drivers: First of all, American family’s wealth has tripled, adjusted for inflation, from $38 trillion in 1989… to $140 trillion in 2022! Second, because the 73 million baby boomers are dying more often, with the youngest turning 60 and the oldest turning 80.

Well, the same report says that, unsurprisingly, those mind-boggling quantities of wealth are set to go to the next generation… primarily the children or other descendants of wealthy boomers.

According to the New York Times, the biggest windfalls will be going to descendants of the already wealthy. Yes, the top 10% hold more than half of the current wealth, while the top 1% hold as much as the bottom 90% (and is predominantly white). The more diverse bottom 50% (in terms of wealth) will account for only 8% of the transfers.

Members of Generation X, born between 1965 and 1980, are set to inherit the most money until 2045. They are expected to be handed $30 trillion.

Millennials, born from 1981 to 1996, with wealthy parents also have reasons to be pleased, at least about their financial future. According to the Cerulli report, they can expect to inherit $27 trillion.

Those in Gen Z, born between 1997 and 2012, are set to benefit from the great wealth transfer too – just not as much as their older counterparts, for now. They are expected to be handed $11 trillion in the next 20 years. But after that, they can expect to get what’s left from their Gen X and Millenial parents.

The RBC Wealth Management’s Wealth Transfer Report found that more than half (61%) of Americans said they intend to transfer all of their assets upon death. Of course, end of life expenses and retirement can be costly.

However, Merryl Lynch reported that the wealthy are increasingly leaning into the trend of “giving while living.” This means giving away a large chunk while they are still alive in the form of down payments for homes, college tuition, money to start a business or just cash transfers.

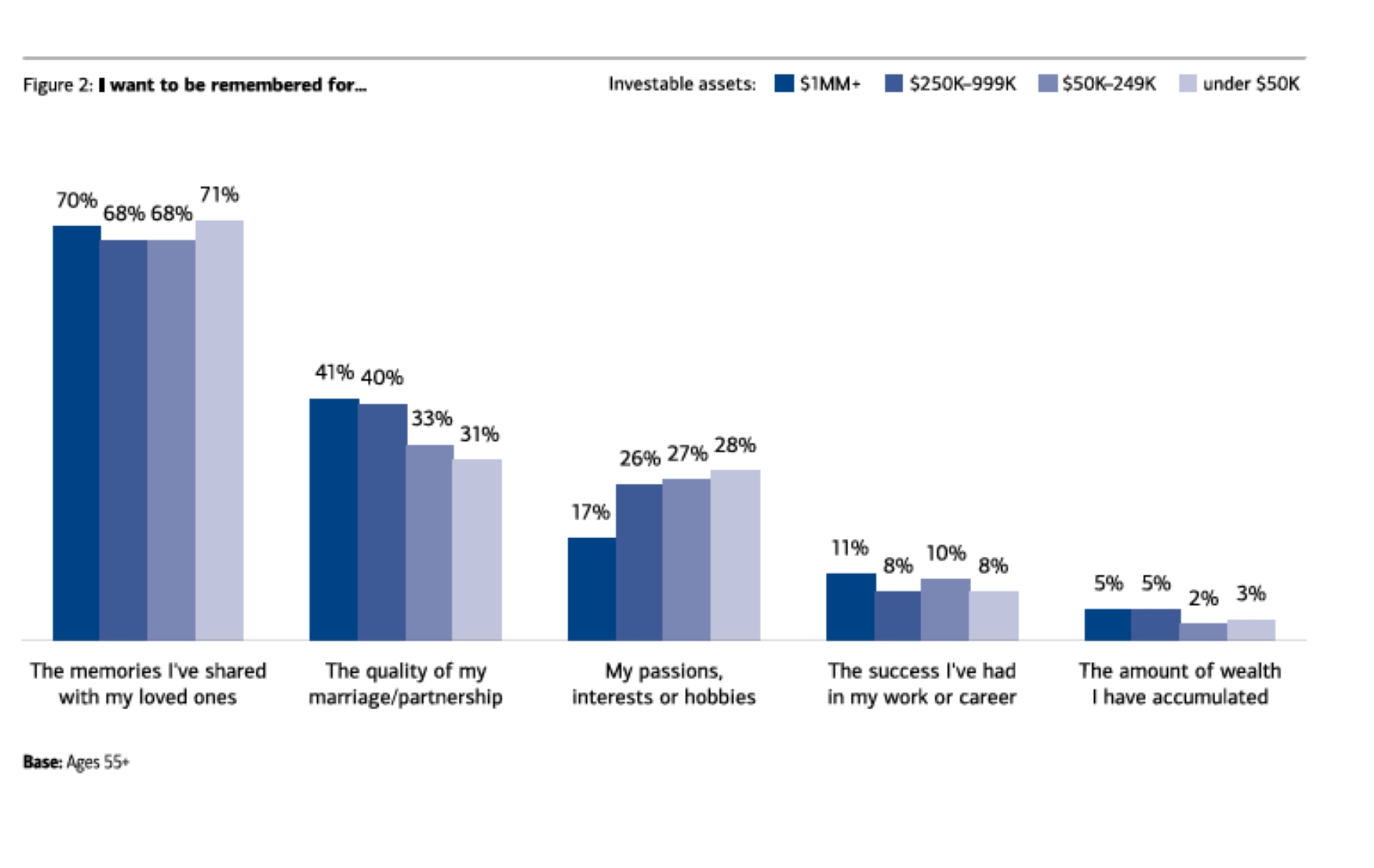

While there is no denying the massive sums of money being passed down from generation to generation when asking about legacy, a Bank of America survey found that money was the least important thing on people's minds. Ahead were memories shared with loved ones; the quality of partnerships; passions, interests or hobbies; or work or career success.

Image: Bank of America

Of course, the wealth transfer will be a boon for generations that arguably haven’t had it quite as easy as their (wealthy) boomer parents. For instance, the cost of buying a house has risen about 500% since boomers were in their 20s and 30s, their prime real estate buying years. The S&P stock market index has also risen by more than 2,800% since then.

In 2019, the St. Louis Fed found that the median, older millennial household owned only 11 percent less wealth than the typical boomer household had at the same age. However, that was generally, according to NY Mag — indeed, the college-educated millennials are closer to matching the boomers’ pace of savings.

According to the NYT mag, the great wealth transfer is set to exacerbate inequality - and not only the economic kind. “Wealthy, white millennials will claim a massively disproportionate share of the impending inheritances and intergenerational gifts,” according to the NYT, becoming the wealthiest Americans ever known. Meanwhile, working-class millennials are set to be worse off than their parents.

Image: Scrooge McDuck and Money (Walt Disney, 1967)

In 2021, Deutsche Bank warned its clients that millennials were coming after their wealth. A research note said that the generation gaining political power could be “a potential turning point for society and start to change election results and thus change policy.” It warns of “a harsher inheritance tax regime, less income protection for pensioners, more property taxes, along with greater income and corporate taxes … and all-round more redistributive policies.”

The NYT suggests that the inequality could be so stark between the have and have-not millennials that polarization and hatred between classes could increase. For one, millennials without high incomes or help from their parents are already locked out of the expensive housing market (thus, the American dream). Indeed, Bernie Sanders did much better with public college students than at Ivy League universities. Could it be a sign of things to come?

More for you

Top Stories