A drive to tax the super rich gathers pace

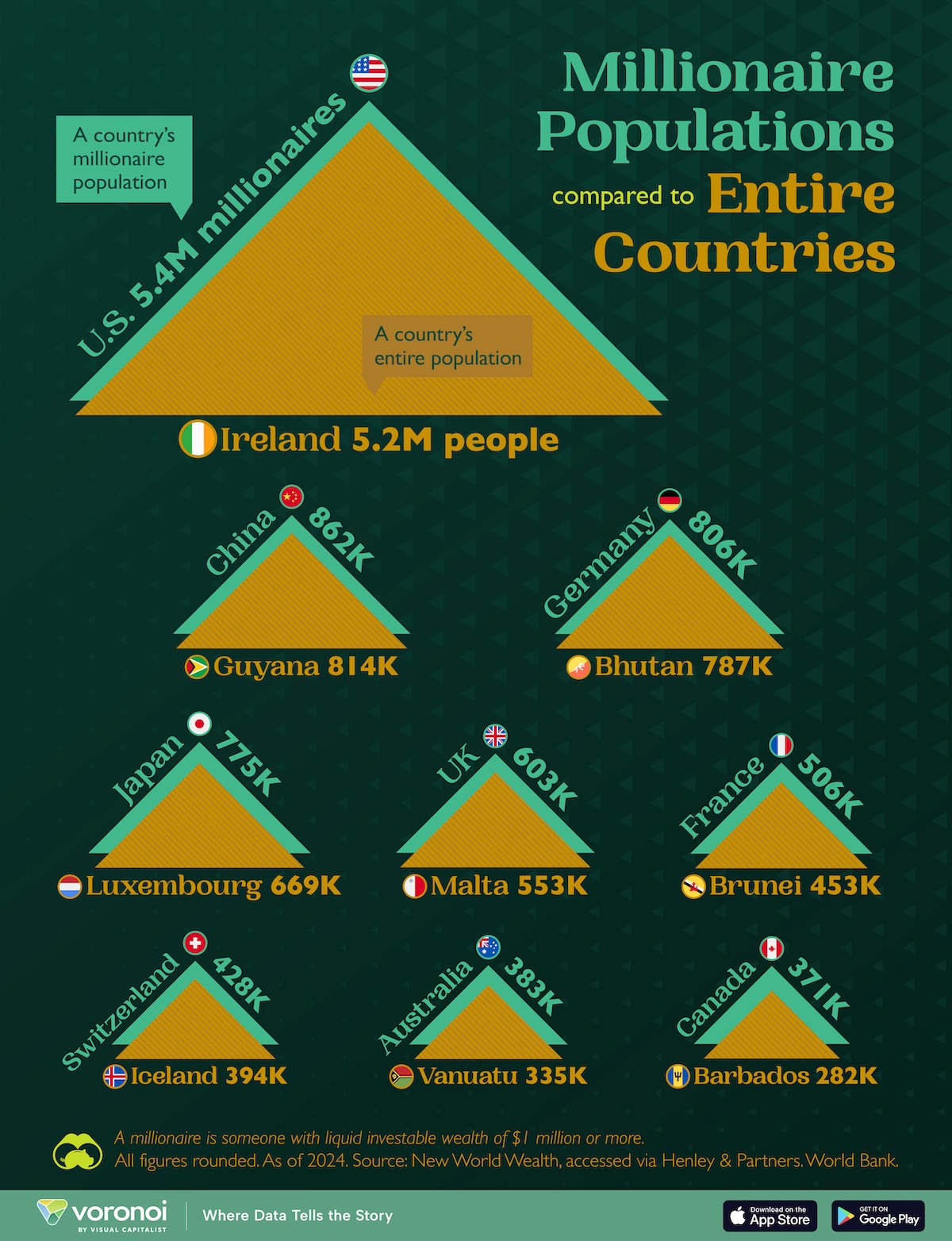

The gulf between rich and poor has become so exaggerated that even the billionaires themselves are crying out for something to be done. Recently, 260 billionaires and millionaires signed an open letter regarding tax, entitled Proud to Pay More.

A so-called “featherlight” tax on the world’s 0.5% wealthiest, applying a rate of between 1.7% and 3.5%, would ratchet up around $2.1tn, according to new research from the London-based platform, Tax Justice Network.

The campaign group for a fairer world flags up the Spanish tax on wealth as an example of how introducing such a measure might work.

Spain is the only country in the EU to place a tax on the global wealth of individuals when it exceeds a certain amount, though due regional control of the tax, more than a few have slipped through the net – in the Madrid region, for example.

At a meeting in Rio de Janeiro in July, finance ministers from G20 countries agreed on the need to discuss a strategy to tax the world's richest individuals while stopping short of actually hammering one out.

The idea is a priority for Brazil with Brazilian finance minister Fernando Haddad welcoming what he termed an “historic” step forward, according to Politico.

Brazil’s climate minister Ana Toni explained her government’s proposal of a 2% tax on the global elite. The scheme would target just 3,000 of the super-rich, raising $250 billion.

The Tax Justice Network’s findings ahead of the COP29 later this year reveal that their proposed “featherlight” tax on the global elite could fund the external climate bill for developing countries twice over.

According to calculations by Oxfam, the wealth of billionaires has accelerated in recent years to the extent that keeping it from multiplying further would require an annual tax of 12.8%, reports The Guardian.

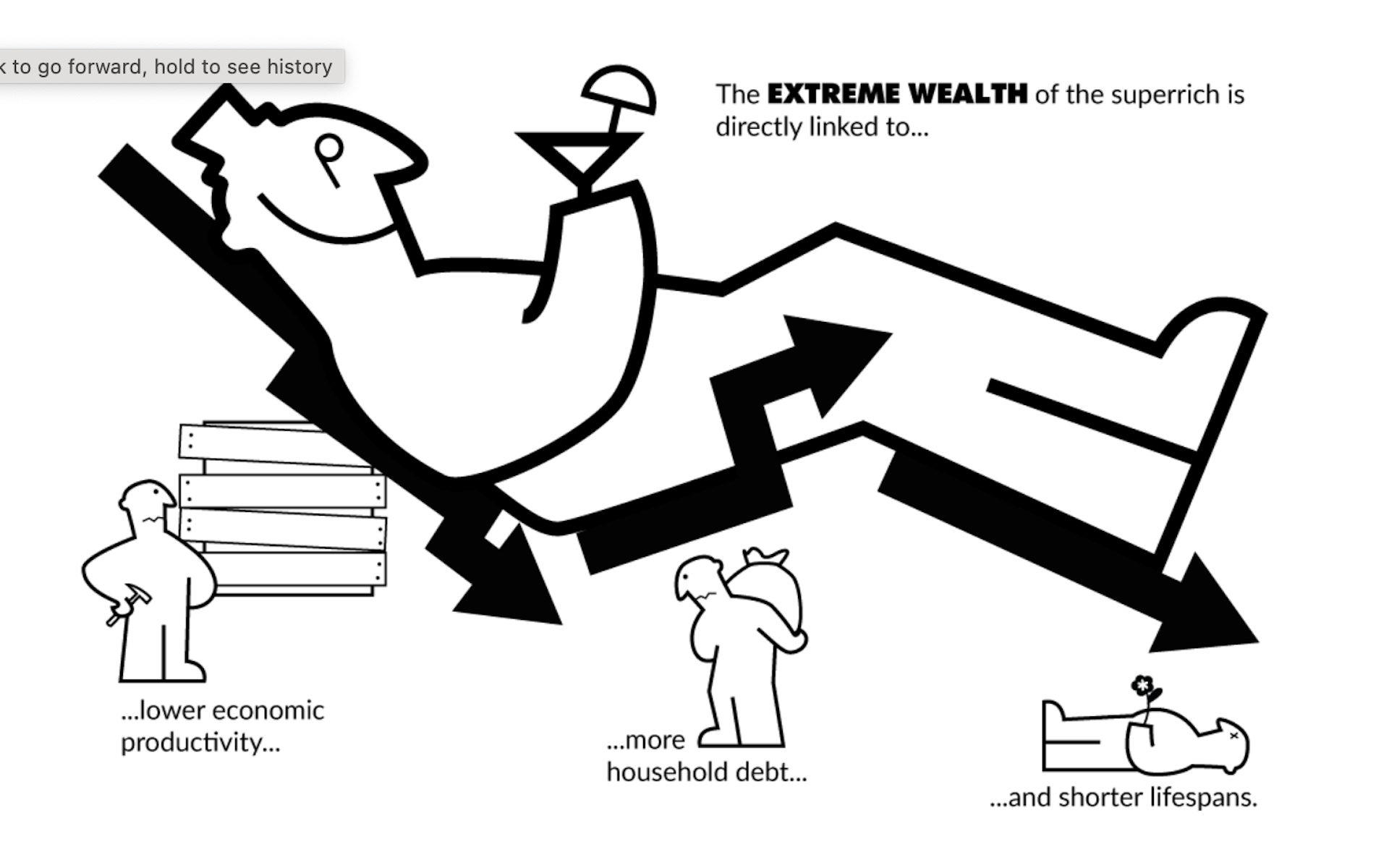

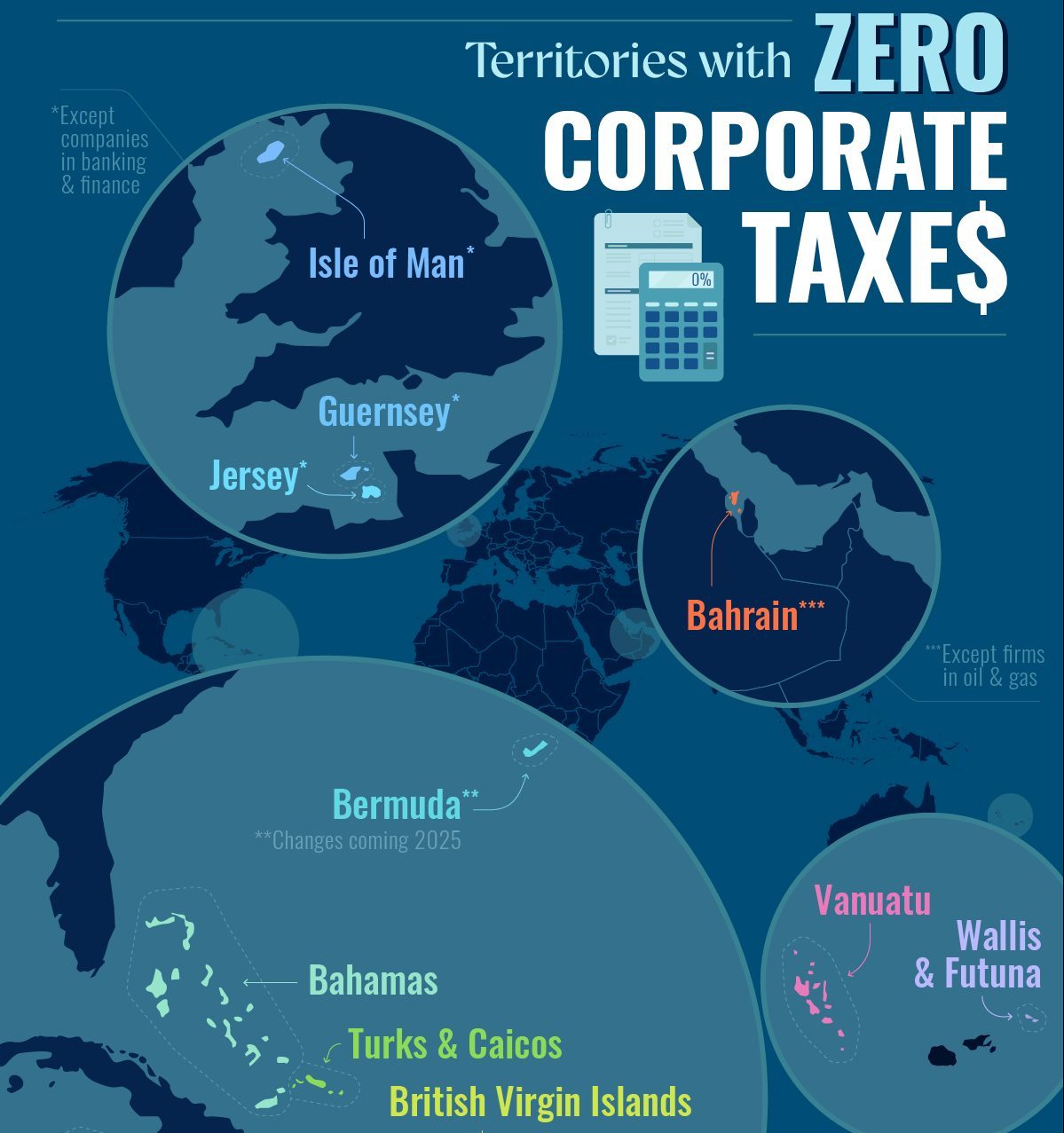

The Tax Justice Network claims that, under pressure from corporate giants and the global elite, governments have set tax rates at an all time low for these entities and individuals despite their fortunes reaching record levels.

“For the first time, in 2018, US billionaires paid less tax than their secretaries,” according to the Tax Justice Network study.

Photo: screenshot from the Tax Justice Network platform.

Over half of millionaires polled in G20 countries think extreme wealth is a “threat to democracy,” according to the Tax Justice Network platform.

“We have seen the five richest men in the world doubling their fortunes since 2020, while 5 billion poor people have seen their wealth decline,” Rebecca Gowland, international director of Patriotic Millionaires told Spanish news site El Pais.

“The current economic system is designed to benefit a handful of very wealthy people. Working people pay much higher tax rates.”

In 2010, 60 millionaires in the US signed a letter to former President Barack Obama asking him to levy taxes on the largest fortunes. This move led to the Patriotic Millionaires organization being set up.

“I’m not any more altruistic than the next guy, I’m just greedy for a different kind of country than most other rich people. I want to be a rich man in a rich country,” says Patriotic Millionaires’ Chair, Morris Pearl, former Managing Director at BlackRock on the platform.

The proposals coming out of Brazil from the G20 Finance Ministers’ meeting in Rio de Janeiro have the support of France, Germany, Spain and South Africa.

Yet not all countries are on board, according to the Tax Justice Network, and this feet dragging could delay the introduction of any such tax for years.

“A minority of rich countries still seem to be holding back from support for a robust framework convention on tax,” Alison Schultz, a research fellow at the Tax Justice Network, said on their platform.

“This needs to change now – the climate can’t wait, and nor can the people of the world,” Schultz added.

Elon Musk is the world’s richest man with an eyewatering $248.9 bn. Jeff Bezos is second with $198.5 bn. Next is LVMH’s Bernard Arnault at $192.8 and fourth is Mark Zuckerberg with a stash of $185.3 bn.

More for you

Top Stories