Eliminating taxes on tips is a bad idea, economists say

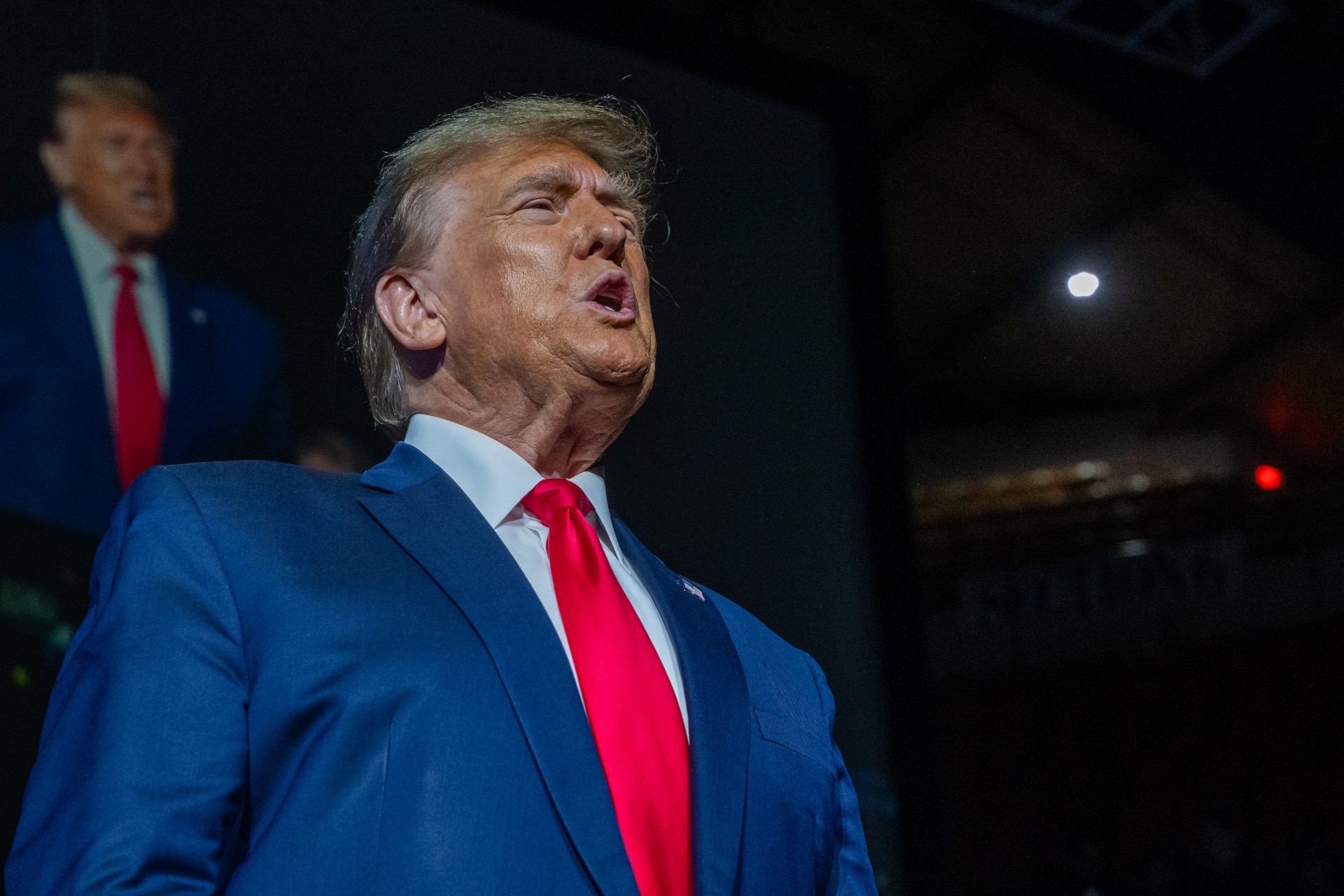

Former President Donald Trump and Vice President Kamala Harris have proposed to exclude tips from federal income taxes. The idea has sparked controversy between the candidates and among experts.

Mr. Trump shared his proposal in Nevada. According to The New York Times, he said the idea came from a conversation with a waitress in Las Vegas. His pitch was simple: no tax on tips.

Ms. Harris endorsed her version of the same idea during a speech, also in Nevada. Her proposal included raising the minimum wage and specifying the workers who would benefit.

According to NPR, the idea quickly gained positive traction in Nevada. The Culinary Union, which represents over 60,000 hospitality workers, supported it, the broadcaster said.

The Vice President’s speech infuriated the Republican candidate, who called her a “copycat,” taking advantage of the endorsement to form a political attack.

However, beyond the who-thought-of-it-first battle, taxing experts and economists across the political spectrum are not so eager to accept the proposals as a good idea.

Sanjay Gupta, an accounting professor at Michigan State, told McClatchy News the idea was “unfair, inefficient” and unnecessarily complex on declarations collected by the Miami Herald.

According to the newspaper, 95% of low-to-moderate-income workers do not receive tips. Mr. Gupta pointed out that this practice can be unfair even inside heavy tipping industries like service.

The newspaper also gathered the words of Alex Muresianu, a senior policy analyst at the Tax Foundation, to McClatchy News, saying it would be inefficient since most workers don’t qualify for income taxes.

UNLV tax law professor Francine Lipman told NPR that the proposal does not address the issue affecting service workers: hourly wages. She thinks raising the wages would be more efficient.

According to the NY Times, businesses in some states can pay workers as little as $2.13 an hour as long as they receive enough tips to raise them to the full minimum wage.

The experts who talked to the NY Times argued that a tax cut on tips would only promote a tipping culture that is starting to spiral out of control and allow businesses to underpay workers.

According to the newspaper, private data has shown that businesses have grown increasingly reliant on tips, even in industries that did not use them before. Customers have caught on to that.

Early in the pandemic, The New York Times explained, Americans were eager to compensate service workers for their efforts. Afterward, restaurants increased tip requests to raise wages in a labor shortage.

However, tips are an insecure earning method for workers unsure how much they will earn weekly. That is not considering consumers are growing tired of the constant pleas.

Tips might round up wages, but they do not count toward other benefits like Social Security or when requesting credit to purchase homes or vehicles.

More for you

Top Stories