Why the Fed will make fewer cuts to interest rates in 2025

The Federal Reserve made its last interest rate cut in 2024, but it also delivered bad news: it will make fewer cuts in 2025 than it had previously planned.

The interest rates, which condition bank-to-bank loans but influence the rest of the economy, are now between 4.25 and 4.5 points, still much higher than in 2022.

According to NBC, the agency now predicts that the target 2% inflation will come in 2026. That is why they decided to cut rates only two times next year.

The stock market fell sharply after the Fed announced it would not cut rates again soon. According to the Wall Street Journal, the Nasdaq dropped 3.6%, the Dow 2.6%, and the S&P 500 nearly 3%.

The Fed examines the economy's state to determine whether to keep, lower, or increase rates. Its goal is to solve the high price crisis without causing a recession.

To control inflation, the Fed makes it less attractive to borrow and invest. However, inflation has become sticky as the labor market keeps strong and Americans keep spending despite high prices.

The November inflation numbers prove that. According to NBC, prices were higher despite the economy showing signs of cooling down in the labor market.

The Consumer Price Index, an annual comparison of how expensive things are in a given month, grew 2.7% in November. NBC said the index is the most watched inflation indicator.

According to the Wall Street Journal, prices increased at the fastest monthly pace in a year and a half. The newspaper said specific products, like vehicles, drove the increase.

Food prices also contributed significantly to the overall rise. CNN identified products that contributed most to Americans' increased grocery bill: coffee, orange juice, beef, and eggs are examples.

Exports told NBC that the Fed is also pushing for a cautious approach because there is uncertainty about the new Trump Administration's effect on the economy.

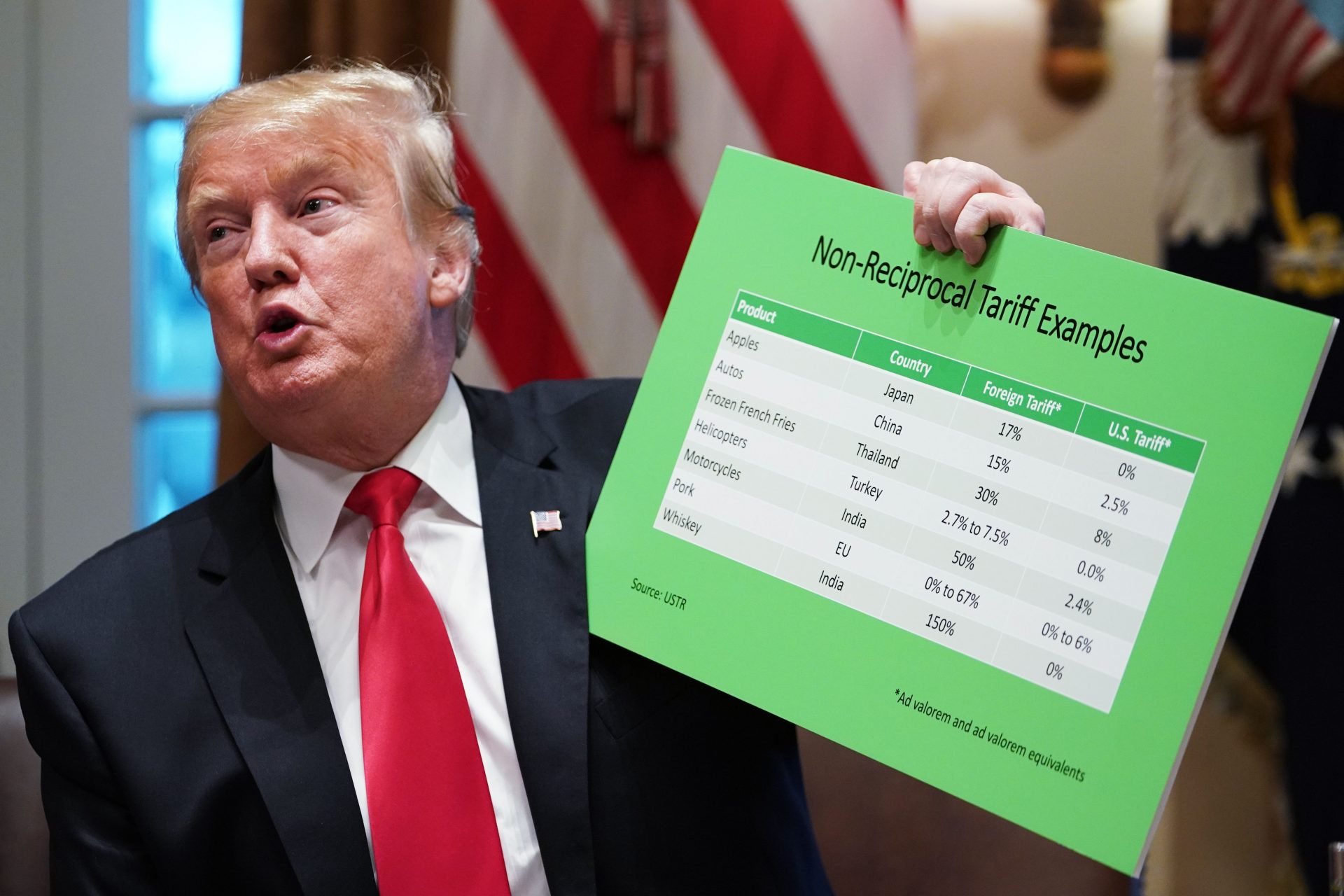

Many businesses, consumers, and investors are concerned about the tariffs President-elect Trump plans to impose, given that they are likely to increase prices even further.

President-elect Trump has promised to impose high tariffs on China, Canada, Mexico, and the BRICS countries (Brazil, India, South Africa, and the United Arab Emirates, among others).

The announcement has pushed some buyers to stockpile in preparation. Some fear that essential daily products could become much more expensive.

According to the WSJ, retailers could also be raising prices in preparation for future inflation and tariffs. The trajectory of prices contributes to the decisions that determine today's price tags.

The newspaper also said manufacturers are stockpiling imported parts and raw materials, which can drive up global demand for certain products and change prices.

More for you

Top Stories