Brazil's BRICS proposal has Trump's blood boiling

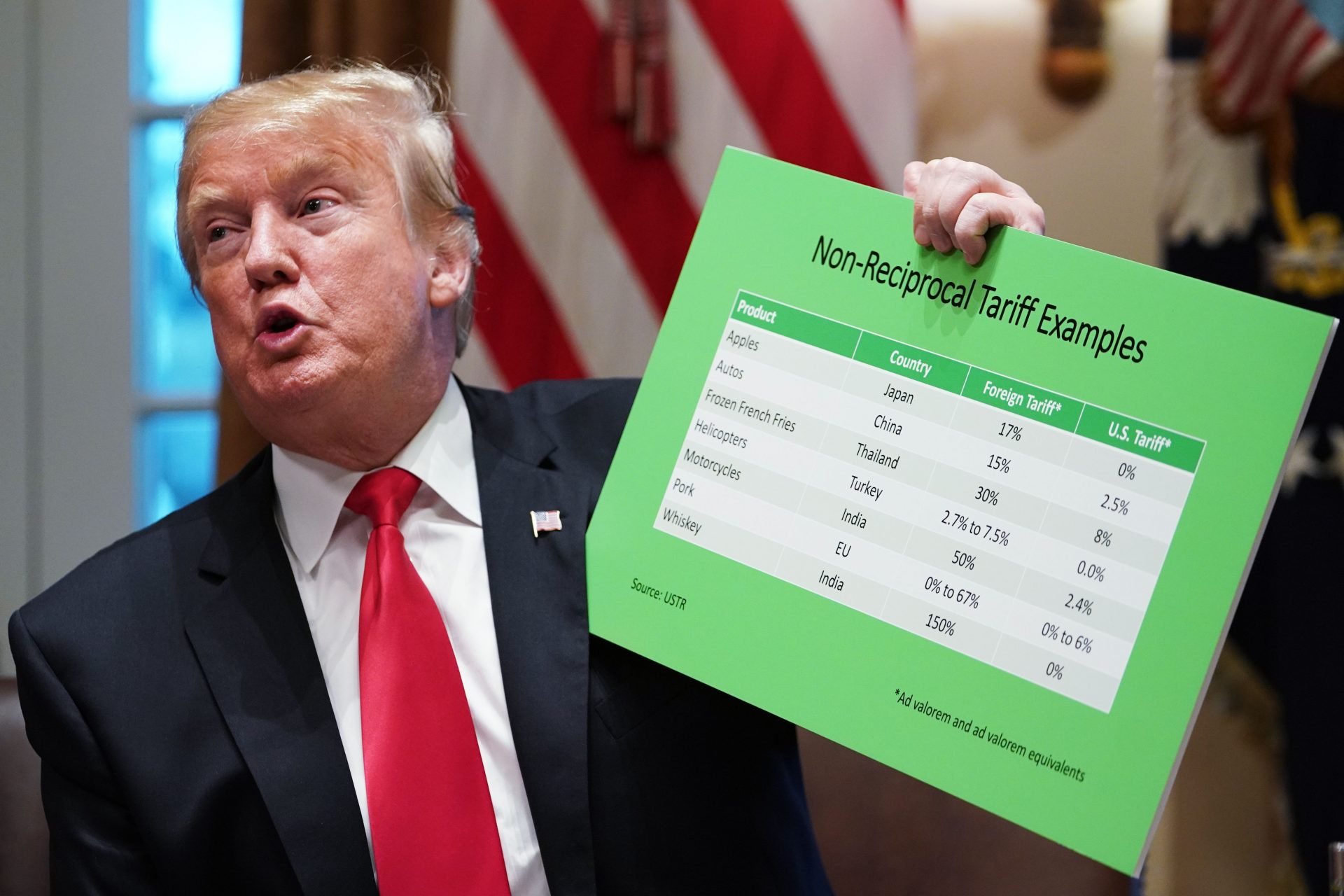

The President-elect of the United States, Donald Trump, has sternly warned the BRICS nations against pursuing or supporting alternative currencies that could challenge the dominance of the U.S. dollar. According to the BBC, Trump expressed his concerns on his social media platform, Truth Social, emphasizing the need to maintain the dollar's leading role in the global financial system.

Trump wrote, "The idea that the BRICS Countries are trying to move away from the Dollar while we stand by and watch is OVER," on November 30.

Trump continued, “We require a commitment from these countries that they will neither create a new Brics currency nor back any other currency to replace the mighty US dollar or they will face 100% tariffs and should expect to say goodbye to selling into the wonderful US economy. They can go find another s u c k e r."

Since 2011, Brazil, Russia, India, China and South Africa have been members of the BRICS. This year, in the bloc's first expansion in over a decade, Iran, Saudi Arabia, the United Arab Emirates, Ethiopia and Egypt were formally incorporated. In addition, 34 other countries have expressed interest in joining the group.

According to the Brazilian newspaper Folha de S. Paulo, in October, when the BRICS summit met in Russia, the president of Brazil, Luiz Inácio Lula da Silva, defended the idea that the countries of the bloc should seek alternative means of payment among themselves to reduce dependence on the use of the dollar.

The development of a compensation mechanism in local currencies for the BRICS is one of the priorities of Brazil, which assumes the presidency of the bloc this year and during 2025.

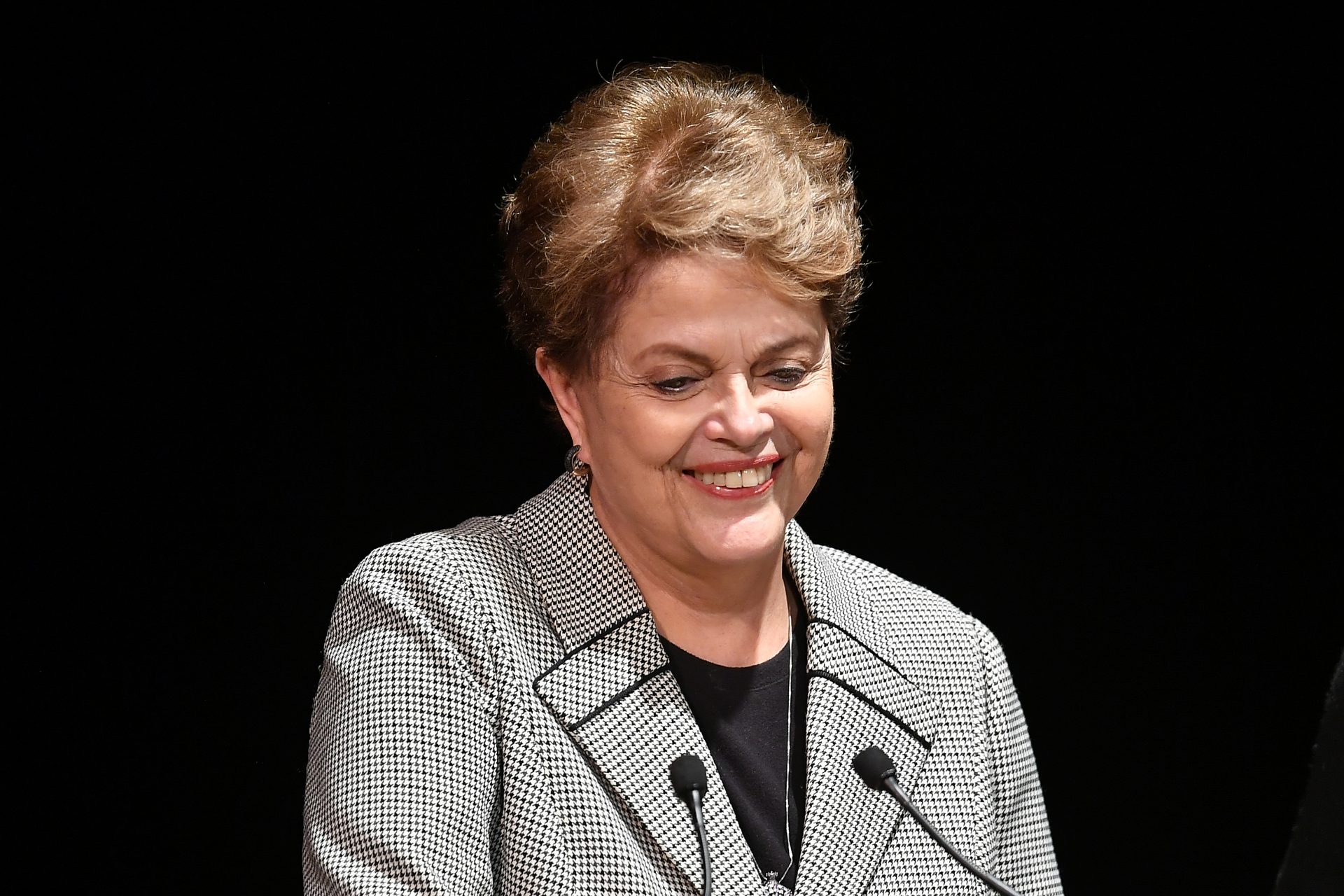

In addition to accelerating this proposal to be less dependent on the dollar, Brazil also wants to increase the role of the New Development Bank, the BRICS bank, currently under the presidency of former Brazilian president Dilma Rousseff.

Since 1944, the dollar has been the standard currency for international transactions. Trade between countries traditionally involves converting local currencies into the US dollar.

And although the dollar has a strong global position, relying on it leaves other countries vulnerable to its fluctuations and to US monetary policy.

One alternative that is already being used in some transactions is the use of the yuan, China's currency.

When Russia was excluded from the SWIFT system, the Asian giant, one of its major trading partners, took advantage of the situation to encourage exchanges in its currency, thus trying to strengthen its economy against the US.

The replacement of the dollar is unlikely to be consolidated in the short term, but the BRICS appears to have the necessary weight to promote an alternative.

As highlighted by Brazilian newspaper G1, the member countries represent 46% of the world's population and their combined GDP is already greater than that of the traditional Western powers, according to projections by the International Monetary Fund, so Luiz Inácio Lula da Silva's proposal is certainly a threat to the United States.

More for you

Top Stories