Car companies are secretly recording how you drive

With the invention of artificial intelligence, we now live in a world where we are monitored more than ever. Recently, the New York Times exposed how if you drive a modern car with an internet connection, there is a good chance that your car manufacturer is sending details and revealing information to car insurance providers often without drivers' knowledge.

The New York Times spoke to Kenn Dahl, who drives a leased Chevrolet Bolt. Dahl told the newspaper he was shocked when his car insurance price increased by a whopping 21% in 2022.

When Kenn Dahl contacted his insurance company, he was told that the increase in his car insurance price was likely due to information found in his LexisNexis report.

According to the New York Times, "LexisNexis is a New York-based global data broker with a "Risk Solutions" division that caters to the auto insurance industry and has traditionally kept tabs on car accidents and tickets."

After requesting his LexisNexis report, Mr Dahl discovered that the report was 258 pages long and contained all the details on how he and his wife drove over the course of six months, including everything from rapid accelerations and hard braking to how often they drove the vehicle and how far they went. All this information was provided to LexisNexis by General Motors, the manufacturer of Dahl's Chevrolet Bolt and without the owner's knowledge.

Dahl saw his insurance price increase because LexisNexis used the data from his driving to create a risk score, which, as LexisNexis spokesman Dean Carney told the New York Times, is created "for insurers to use as one factor of many to create more personalized insurance coverage."

Upon learning how his driving information was being shared without his knowledge, Kenn Dahl told the New York Times, "It felt like a betrayal. They're taking information that I didn't realize was going to be shared and screwing with our insurance."

If you are like us, you are probably wondering how is this legal? How can private information be shared by car manufacturers to insurance companies without our knowledge?

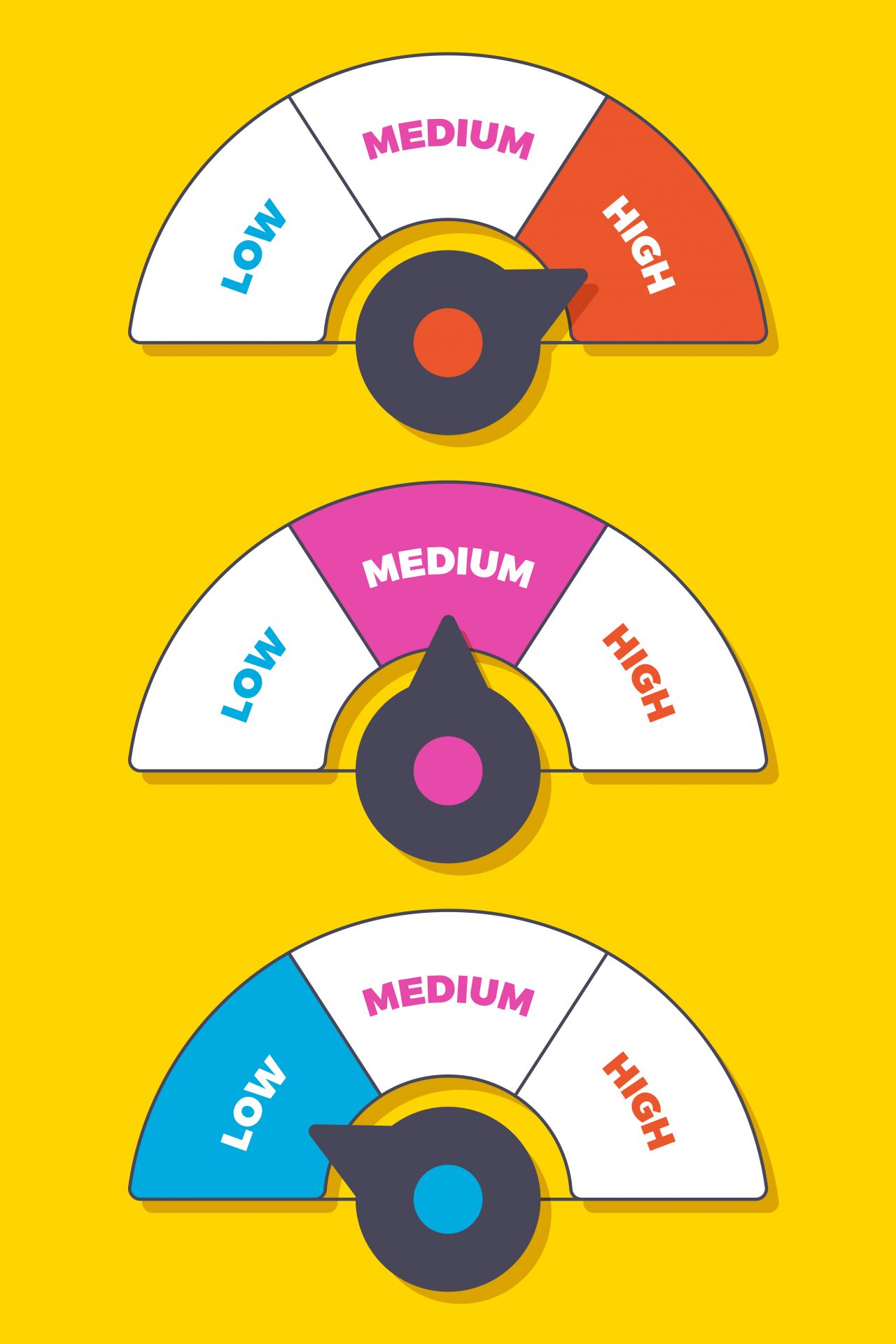

The Times highlights that over the past few years, insurance companies have tried to convince drivers to voluntarily share information about their driving, such as the speed at which they drive or how quickly they drive around corners, collected via dongles or smartphone apps. However, drivers were not very keen on doing so.

So, insurance companies found a way around this problem. Since most new vehicles have an internet connection, insurance companies have found a way to gather this information without drivers' consent (in many cases) by gathering the information collected by car companies.

However, while car manufacturers and data brokers claim to have permission from drivers to collect this sensitive information, most drivers have no idea they are being monitored. The New York Times points out that usually, the partnerships between data brokers and automakers are hidden in "fine print and murky privacy policies that few read."

In the article, the New York Times focuses on General Motors' OnStar Smart Driver service, which is a new offering within OnStar that launched in 2016. Essentially, the service claims it helps drivers to monitor their own driving habits and keep themselves safe. According to Business Insider, OnStar has a system where drivers earn badges if they follow the speed limit and brake softly.

Photo: OnStar, General Motors

General Motors told the New York Times that only "select insights" about how people drive are shared with LexisNexis and that customers can choose whether to use the service.

Malorie Lucich told the Times, "GM's OnStar Smart Driver service is optional to customers. Customer benefits include learning more about their safe driving behaviors or vehicle performance that, with their consent, may be used to obtain insurance quotes. Customers can also unenroll from Smart Driver at any time."

While the service is supposedly activated by the car owner upon purchase or after via a phone app, the New York Times discovered that GM company manuals indicate that salespeople receive bonuses for each person they successfully enrolled in the program. This makes it very likely that customers are being signed up for SmartDriver without their knowledge when they purchase their car at the dealership.

It all seems very shady, but General Motors insists they are not doing anything wrong. The company told the Times, "When a customer accepts the user terms and privacy statement (which are separately reviewed in the enrollment flow), they consent to sharing their data with third parties."

The New York Times spoke to Jen Caltrider, a researcher at Mozilla who reviewed the privacy policies for more than 25 car brands in 2023. Caltrider told the newspaper that it is nearly impossible for drivers to understand what they are consenting to, given the complex language and legal terms used.

It seems that new cars are terrible in terms of privacy, and General Motors is certainly not the only car manufacturer collecting driver data to share with LexisNexis. The Times points out that Kia, Subaru, and Mitsubishi also partake in this practice.

Legally, it seems that at the moment, it might be a bit of a grey area. However, some are looking to change that. According to the New York Times, privacy regulators in the state of California are investigating car manufacturer data collection practices, and Senator Edward Markey (pictured) of Massachusetts asked the Federal Trade Commission to investigate the issue in February 2024.

In an interview, Senator Markey said, "If there is now a collusion between automakers and insurance companies using data collected from an unknowing car owner that then raises their insurance rates, that's, from my perspective, a potential per se violation of Section 5 of the Federal Trade Commission Act."

According to Business Insider, if you own a General Motors vehicle and want to know if you are enrolled in Smart Driver, you can check on your vehicle's app. Furthermore, online, in forums such as Reddit, drivers have shared how to unroll from the service.

More for you

Top Stories