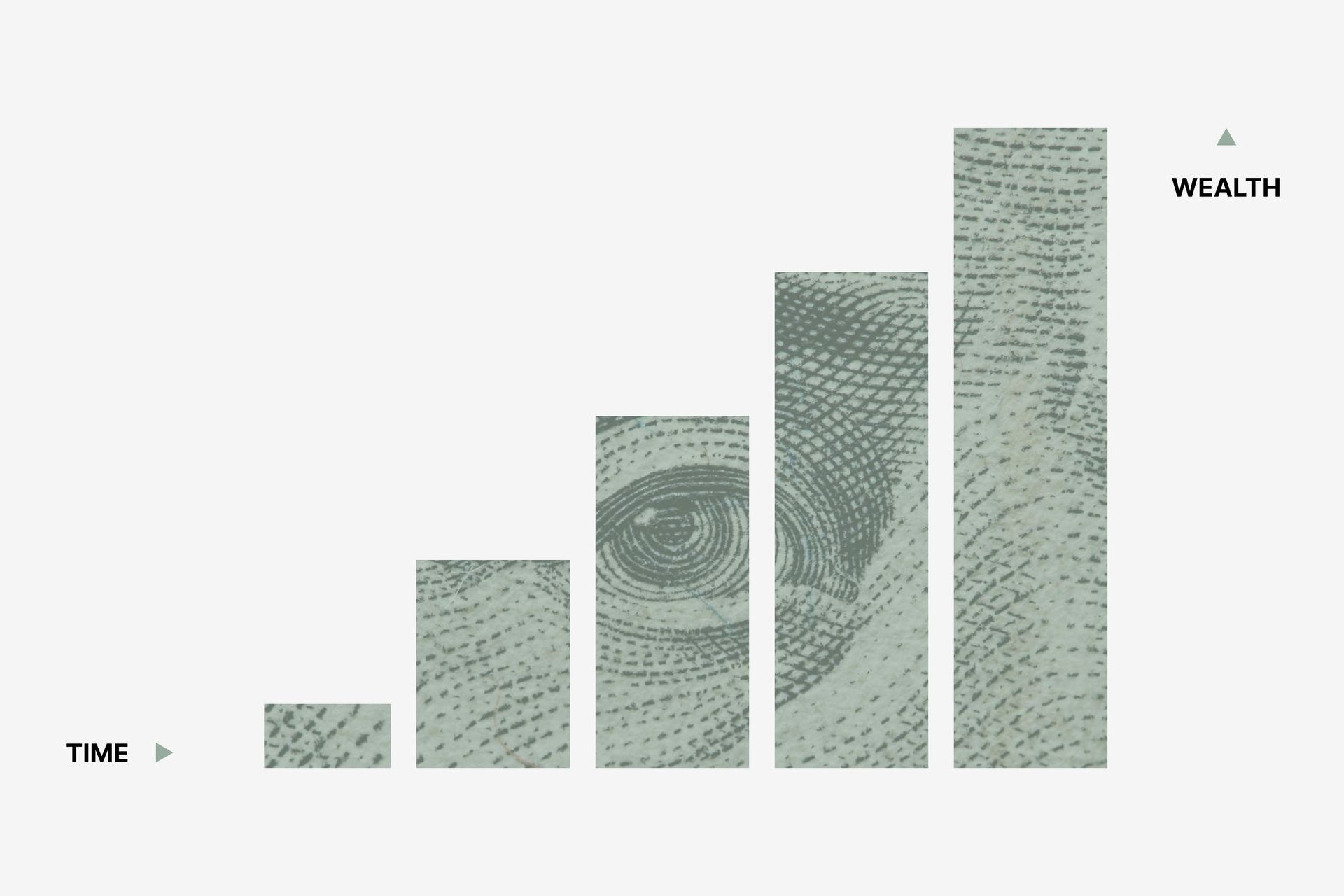

FIRE movement: how young people plan to retire in their 40s

“Financial Independence, Retire Early” (FIRE) is a movement of people who aggressively save and invest, allowing them to quit work sooner rather than to follow a traditional retirement plan.

While the term was coined in the 1992 book ‘Your Money or Your Life’, the FIRE movement has experienced a recent resurgence in popularity, particularly among younger working professionals, according to ‘Forbes’.

Photo: Bruce Mars / Unsplash

The movement prioritizes financial freedom over material wealth. Instead of seeking to accumulate material goods, FIRE followers seek to gain the freedom to spend their time as they wish.

Photo: Jason Briscoe / Unsplash

Economy and finance media ‘Boursorama’ notes that this trend is based on a philosophy of life, based on a “drastic reduction in expenses, massive savings and the implementation of aggressive investment strategies”.

Photo: Andre Taissin / Unsplash

First of all, it is necessary to increase your income and put as much of it aside as possible, ideally between 50% and 75% of the money earned, by adopting a frugal lifestyle.

Photo: Micheile Henderson / Unsplash

‘Buorsorama’ mentions a Youtuber who is a fan of this movement according to whom a savings rate of 75% guarantees financial independence after seven years, compared to 43 years with a savings rate of 15%.

Photo: Alexander Gray / Unsplash

Furthermore, growing your savings quickly requires making aggressive investments, potentially more profitable, but more risky because they are not guaranteed in capital, mainly on the stock markets. Not recommended for the risk-averse out there!

Photo: Morgan Housel / Unsplash

In any case, an OECD study carried out by the Financial Markets Authority in France and published at the end of 2023 revealed that nearly one in four people say they hold financial investments or cryptoassets.

Half of these investors only started in 2020. Among the newcomers, the majority are under 35 years old.

Photo: Sasun Bughdaryan / Unsplash

But what are the motivations that push some young people to want to leave the world of work? “When you are an employee, you exchange your time for money, and as your time is limited, your income is capped,” explains Eliott, 19, to french media ‘Les Échos’.

Photo: Annie Spratt / Unsplash

“I told myself that it was better to have an activity where time and income are uncorrelated, to generate greater income and thus invest,” added the man who has already created his own business.

Photo: Scott Graham / Unsplash

By multiplying sources of income (training, writing books, creating online content), in the long term, the young business owner wants to buy premises and land to rent out.

Photo: Kostiantyn Li / Unsplash

Faced with this appetite for investment, offers abound, particularly online, to train new investors, sometimes promising wonders to an uninformed public.

Photo: Chris Yang / Unsplash

“Dream sellers are putting forward what they present as new ‘El dorados’ that are supposed to bring in big profits: opening an Airbnb concierge service, doing dropshipping, trading, etc.,” denounces Camil Mikolajczack, founder of ‘The Wealth Office’.

Photo: Bruce Mars / Unsplash

“In reality, by financing these training courses, you above all contribute to the financial independence of your trainer,” laughs the expert, who concedes that some of them can still allow you to gradually discover the world of investing.

Photo: Alexander Mils / Unsplash

Camil Mikolajczack warns that “getting rich is a slow process.” He therefore recommends “long-term strategies”, rather than risking losing the capital invested by taking excessive risks to get rich quickly.

Photo: krakenimages / Unsplash

So, is becoming completely financially independent a mirage or a realistic prospect? For Yoann Lopez, founder of ‘Snowball’, a newsletter specializing in investment, the answer is not clear-cut.

Photo: Priscilla Du Preez / Unsplash

Lopez considers that such a prospect is possible for employees, including those with average incomes, provided they deploy “a lot of effort and energy” and reduce their expenses to invest a maximum of money.

Photo: Markus Spiske / Unsplash

‘Boursorama’ considers, on the other hand, that the effort necessary to live on your pension at age 40 requires “enormous sacrifices” and that the ability to achieve this depends too heavily on income and family situation.

Photo: Mathieu Stern / Unsplash

But can we still talk about freedom when we set ourselves so many constraints to achieve an early retirement? And, more importantly, if we achieve that, will we have something that will fulfill our days and give purpose to our lives?

Photo: Jaelynn Castillo / Unsplash

Although, for some, an early retirement may be fulfilling, many people that have achieved the FIRE status have reported feeling empty and anxious; in a constant search for labels to define their identity and purpose, according to ‘Fortune’.

Never miss a story! Click here to follow The Daily Digest.

Photo: Zachary Nelson / Unsplash

More for you

Top Stories