How is one American dollar split up when paying for taxes?

Have you ever wondered where all your taxes are going? It’s not easy to find out exactly how all of your tax dollars are divided up but there is an easy way to understand what is being spent where. Let’s take a look at it.

The United States Bureau of Fiscal Service provides detailed information regarding how your tax dollars are being spent and Visual Capitalist has taken the information from the fiscal that ended September 2023 and turned it into something interesting.

Visual Capitalist is a visual and graphics information website and they broke down how much of one U.S. dollar was being spent on various federal programs, revealing exactly where your federal tax dollars are being sent.

What might surprise you about the data is that Social Security was the largest line item for federal spending. 22% of all federal taxes go to paying for Social Security and not a more headline-making line item like defense spending.

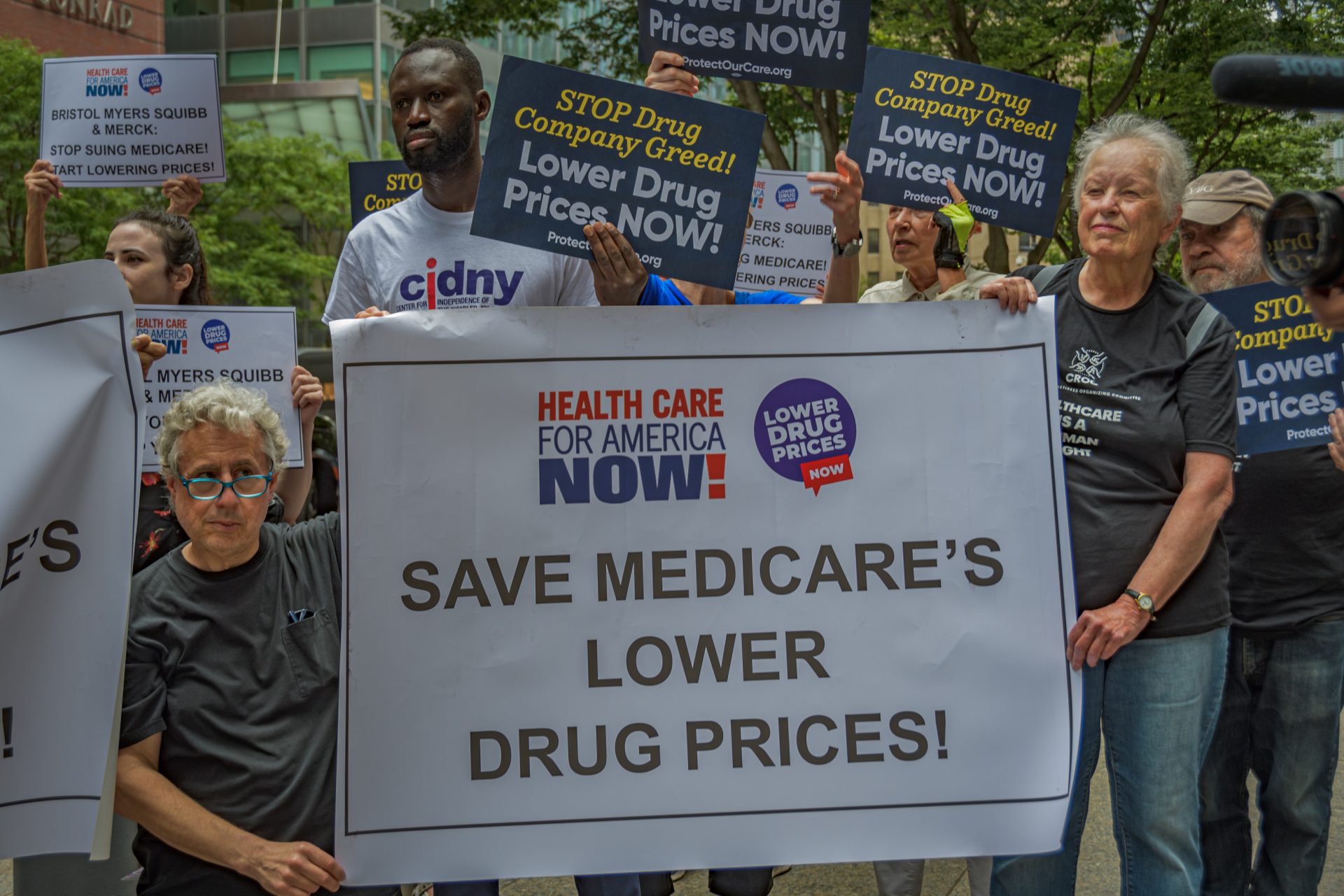

Interestingly, defense spending wasn’t even the second-largest expense for the federal government—it only came in fourth place at 13% of spending. Both Medicare as well as Health spending topped the charts before National Defense.

However, there are several other important line items that are quite expensive and they might surprise. Let’s take a look at the top ten expenses for the federal government so you can get a better understanding of where your tax dollars are going.

Amount Paid Out of $1 Tax Dollar: $0.22

Amount Paid Out of $1 Tax Dollar: $0.14

Amount Paid Out of $1 Tax Dollar: $0.14

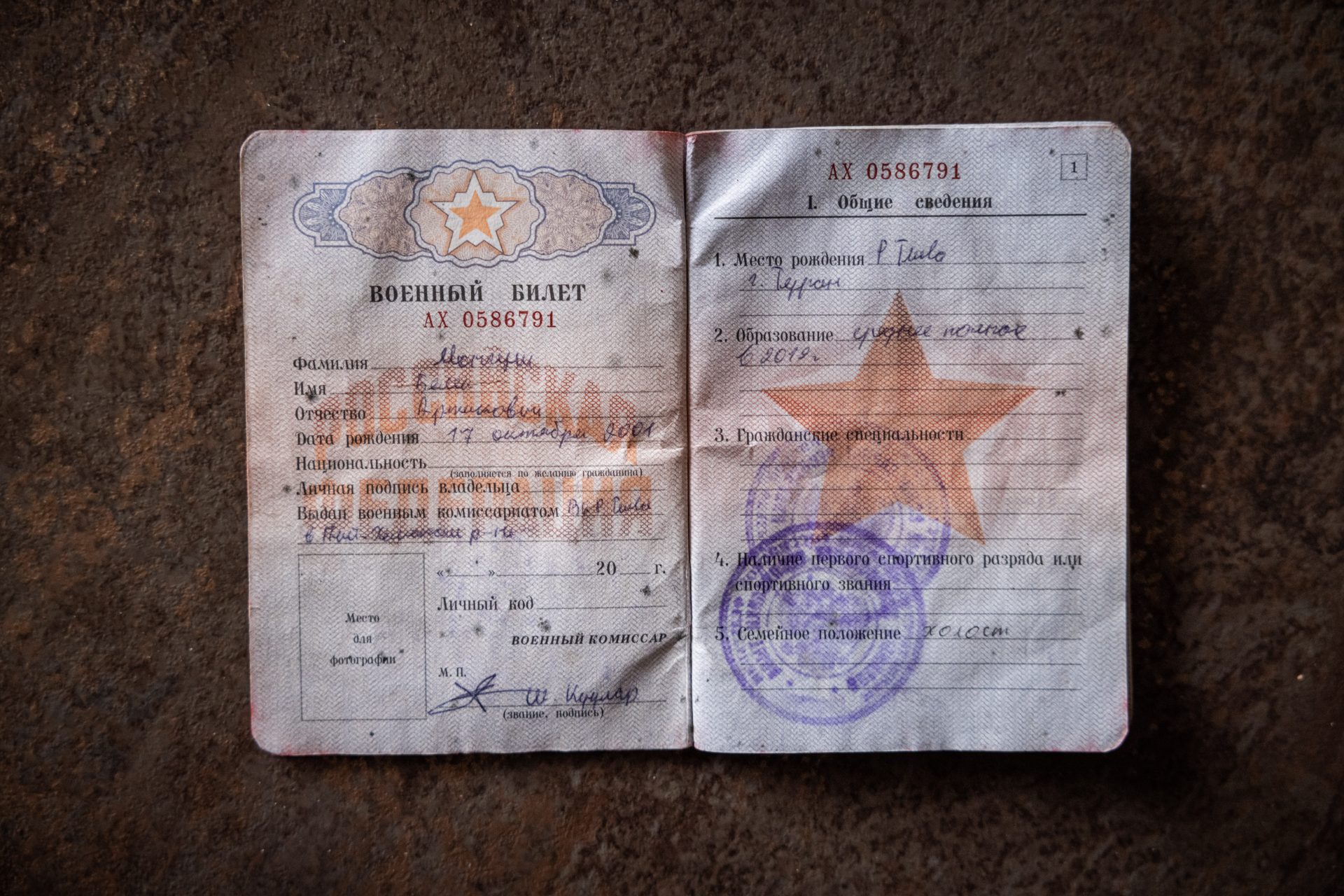

Amount Paid Out of $1 Tax Dollar: $0.13

Amount Paid Out of $1 Tax Dollar: $0.13

Amount Paid Out of $1 Tax Dollar: $0.11

Amount Paid Out of $1 Tax Dollar: $0.05

Amount Paid Out of $1 Tax Dollar: $0.02

Amount Paid Out of $1 Tax Dollar: $0.02

Amount Paid Out of $1 Tax Dollar: $0.04

More for you

Top Stories