High-profile billionaires call for higher taxes for the wealthy, but does it really help?

Over the years, many millionaires (and billionaires) have promised to donate their money to help with poverty and social disparities. However, despite their best intentions, this apparent generosity might not be as helpful as it seems.

The Guardian reported on January 2023 that over 200 millionaires and billionaires have made a call to world leaders to introduce new wealth taxes in order to fight inequality.

The call was made in an open letter released during the 53rd World Economic Forum at Davos, Switzerland.

Signatories of the letter included high-profile personalities such as Abigail Disney (pictured), heiress of the media empire founded by Walt Disney.

Hollywood actor Mark Ruffalo, known for his role as The Hulk in the Marvel Cinematic Universe, also signed the letter.

“The current lack of action is gravely concerning. A meeting of the ‘global elite’ in Davos to discuss ‘cooperation in a fragmented world’ is pointless if you aren’t challenging the root cause of division,” stated the letter.

“Now is the time to tackle extreme wealth; now is the time to tax the ultra-rich,” highlights the signatories, who, according to The Guardian, call themselves 'patriotic millionaires'.

This is not the first such type of call that has been made at Davos. In 2022, a similar letter signed by 102 millionaires and billionaires asked the question: “How do we work together and restore trust?”

Also, in 2019, Hungarian-born billionaire investor George Soros led a letter by a group of rich individuals demanding that the United States approve a new wealth tax.

“America has a moral, ethical and economic responsibility to tax our wealth more. A wealth tax could help address the climate crisis, improve the economy, improve health outcomes, fairly create opportunity, and strengthen our democratic freedoms”, the letter states, as quoted by Forbes magazine.

Meanwhile, in 2010, Microsoft founder Bill Gates launched The Giving Pledge, a campaign to encourage extremely rich individuals to donate at least half of their wealth.

Gates, with the aid of American investor Warren Buffett (pictured), has recruited over 230 millionaires and billionaires in 28 countries to be part of The Giving Pledge.

Among the participants were Facebook founder Mark Zuckerberg, media mogul Ted Turner, Star Wars creator George Lucas, and Standard Oil heir David Rockefeller.

Tesla founder Elon Musk, regarded as one of the richest people in the world, is also part of The Giving Pledge.

“I’ve always believed that if you're in a position to help somebody, you should do it,” declared Bill Gates in 2021, in a statement about the newest to join his cause. However, not everyone considers such initiatives as positive.

In an opinion piece for The Guardian, British writer Paul Vallely (seen here in 2006) argues that “The common assumption that philanthropy automatically results in a redistribution of money is wrong.”

The problem with philanthropy, argues Vallely, is that it is dependent on the wishes and whims of those giving the money and not the needs of those receiving it. Taxation could be a solution for that.

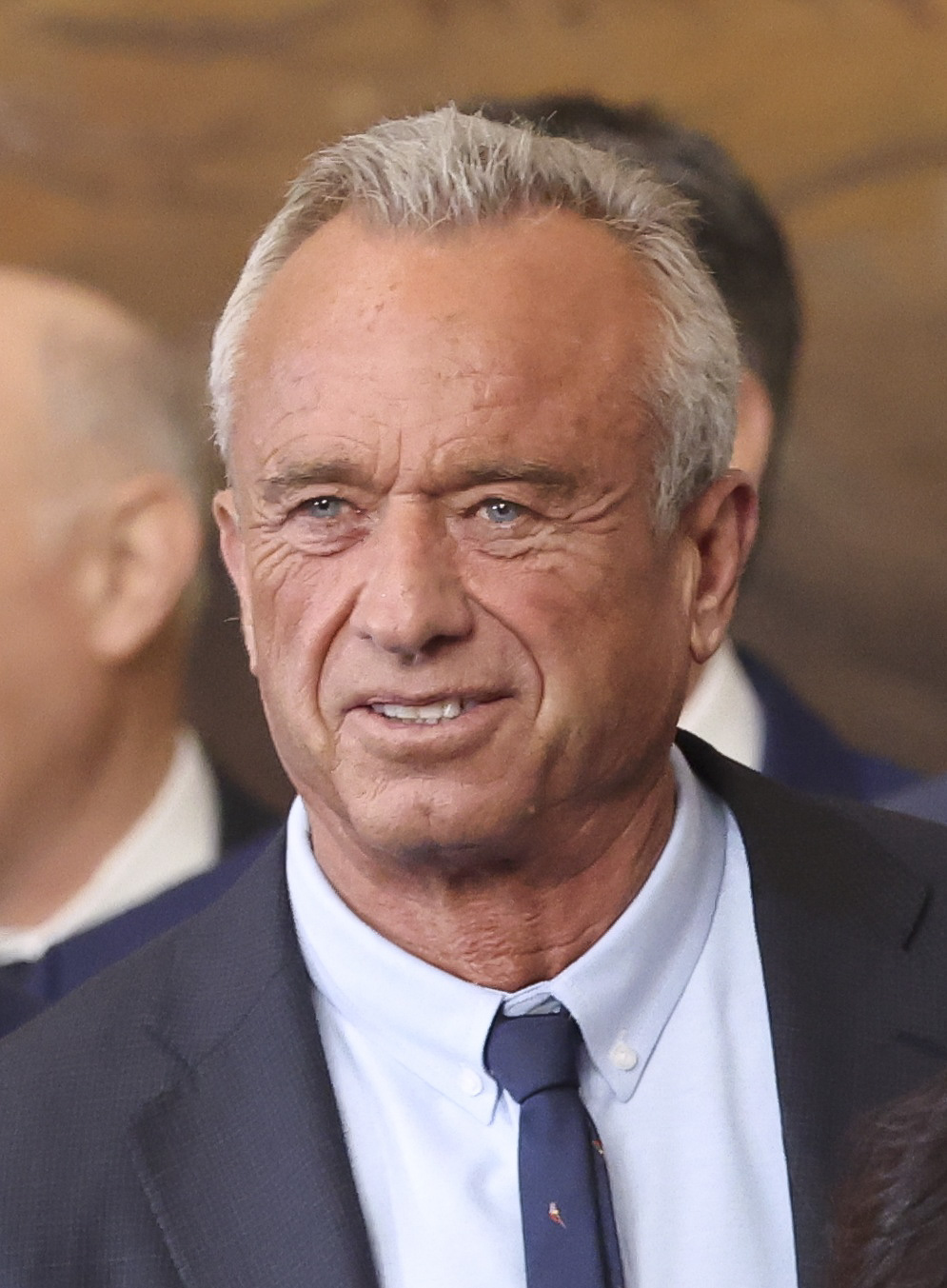

In October 2021, US senator Ron Wyden proposed a “Billionaire Tax Plan” to take into account not just income but overall wealth. However, Republicans and fellow Democratic senators led by Joe Manchin (pictured) opposed it and the plan was quickly defeated.

“There are two tax codes in America,” Senator Wyden declared at the time, as quoted by The New York Times. “One that’s mandatory for workers and one that’s voluntary for billionaires.”

Meanwhile, despite the intention of a few of the top earners in the world, unfair taxation and overall inequality continue.

More for you

Top Stories